Table of contents

- List of Red Flags

- #1: Clear Violation of Objectives defined in Memorandum of Association (MoA)

- #2: Founder's Background

- #3: No Individual Escrow Accounts

- #4: Agreement is Legally Invalid

- #5: Transparency & Deal Details

- #6: Use of Credit Card for Investment Purposes

- #7: Crypto Trading Application by Related Firm

- #8: Auditor Changes in Last Financial Year

- Conclusion

Invoice Discounting is one of the most popular alternative investment options for investors in our community and in general as well. It appeals to them due to its short term tenure (30-60-90 days) and also a decent return (above 10% - 12%). Even ALT INVESTOR does most of the investments in this product due to this.

Looking at this success, multiple platforms have come up offering this product. Each platform is trying to attract pretty much same set of investors mostly by offering higher IRRs/Returns. Falcon's Invoice Discounting is also one such platform where investors can get 20% - 22% IRR on blue chip company invoices (this is what Falcon claims). To give you an idea, the competitors are offering somewhere between 10% - 15% IRR at maximum.

So how can Falcon offer such an high IRR as compared to competitors? Is it even worth investing in the platform? Are they even legit?

Because we couldn't get a chance to run our findings by them, we have written this article independently based on pure facts and we have no intention to damage Falcon's reputation, but have full intent to educate and safeguard our fellow investors in the alternatives space.

If you are unaware of what Invoice Discounting is as a product, we recommend you to read this detailed article written by our team.

List of Red Flags

We will not follow the usual Company Profile structure, but instead write about the Red Flags of this platform due to which investors should think twice/thrice before investing their hard earned money.

#1: Clear Violation of Objectives defined in Memorandum of Association (MoA)

We downloaded all the official documents for Capital Protection Force Pvt Ltd (CPFPL) from MCA (Ministry of Corporate Affairs) and checked their latest Memorandum of Association (MoA) which was last updated on 27th Oct 2020. MoA is like the birth certificate of any private limited company and clearly outlines the company's objectives, scope of main activities and the limitations of it's power.

In CPFPL, there is no mention of invoice discounting or acting as an alternative investment in it's MoA at all. Instead it's 3 main objectives as defined in latest MoA are:

Any additional business that the company does not defined in it's core objectives can be considered as outright illegal until it's present in the MoA. To give an example, below is Jiraaf's (Texterity Private Limited) MoA.

To give another example, here is the MoA for a platform called Invoice Trades (Elite Trade Ventures Pvt. Ltd)

It appears at Falcon (CPFPL) is a purely Human Resource Management business from it's MoA that is present with the MCA at this stage. Given they have been running the Invoice Discounting Business under this entity for some time now, we are unsure of it's legality but we might be missing something.

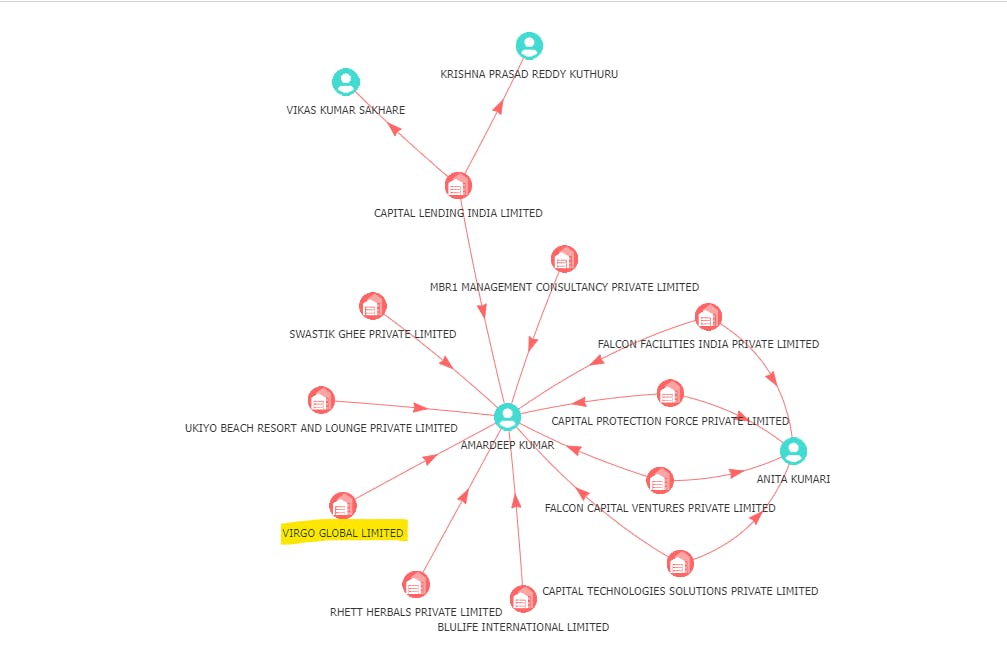

#2: Founder's Background

As per the Website's About Us section, the MD is Amardeep Kumar.

Amardeep is involved in other business as well, notably he was recently appointed as an additional director for Virgo Global Limited as an Additional Director on 10th Nov 2023.

It's a small cap listed company with a market cap of around ₹8.75 Cr and it is unclear what the company actually does, I could not find any relevant employees on Linkedin or anywhere else in public domains, something that you would expect from a listed company.

I couldn't find any notable employees even for Falcon Invoice Discounting on Linkedin, there is no mention of any employee who handles risk, customer support, compliances, etc.

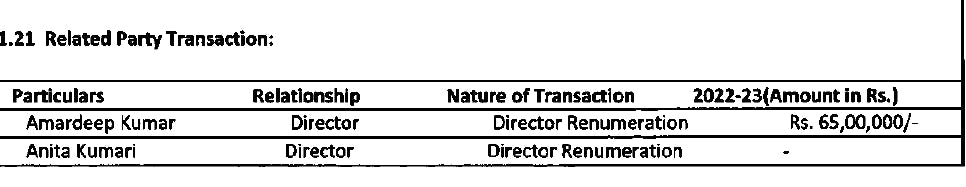

To also note, CPFPL is owned 98.67% by Amardeep Kumar and 1.33% by Anita Kumari and Amardeep got paid ₹65L from the company last FY.

#3: No Individual Escrow Accounts

Usually on all invoice discounting platforms, users get a separate escrow account assigned to them where they can transfer money and that money is directly provisioned to the company that has come to get it's invoice discounted. In case of Falcon, the bank account mentioned in the invoice discounting agreement is mentioned as escrow but not actually an escrow account.

Image from Agreement

Image from Financial Statements

You can clearly see Falcon is showing the bank balance in this account as it's own asset rather than showing it as a liability since money is deposited by the customer.

This is high risk as you don't know how your money is being utilized once it reaches the bank accounts of the company.

#4: Agreement is Legally Invalid

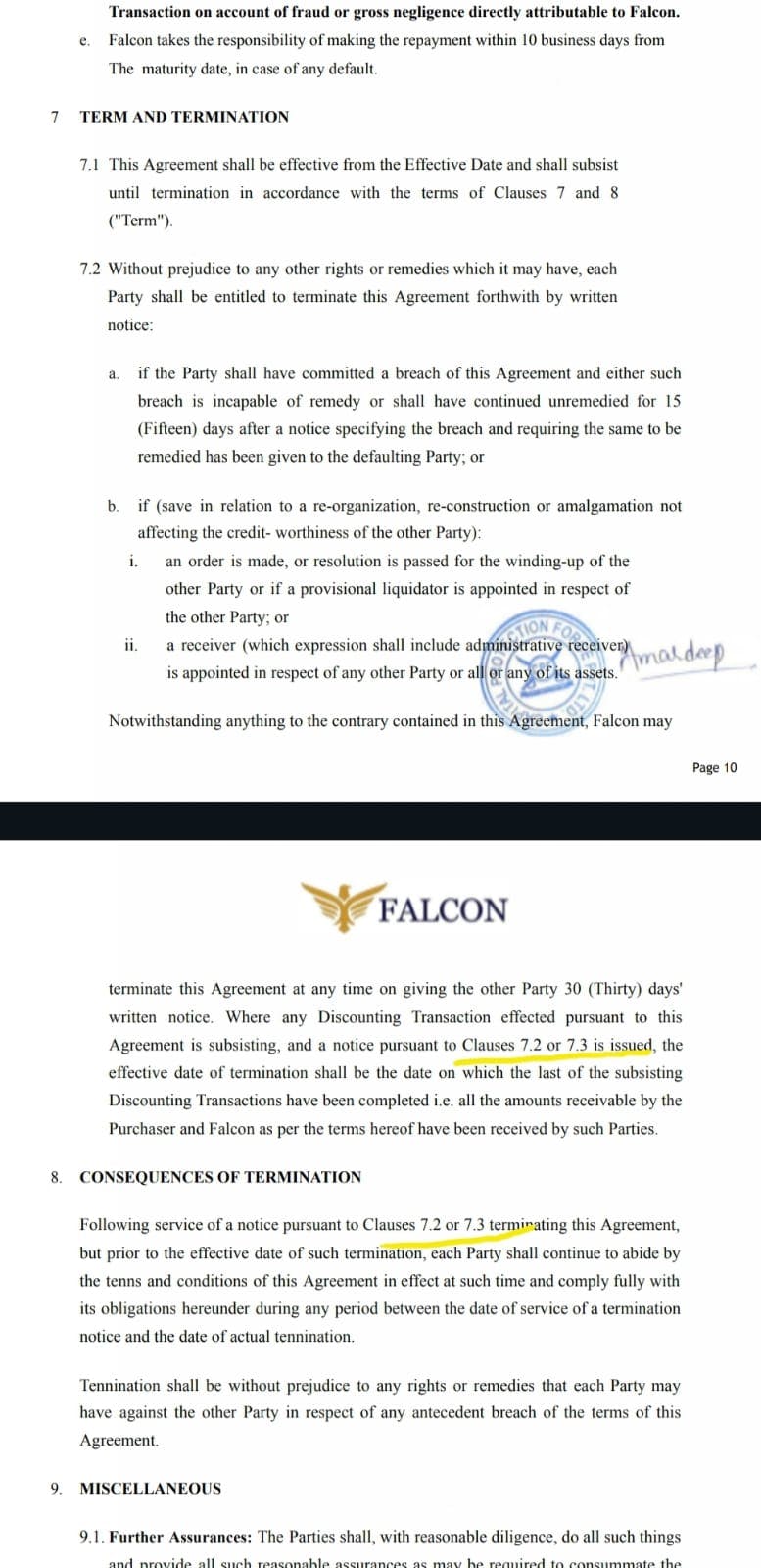

The discounting agreement that is shared post investment is not executed on stamp paper, even if we leave that aside for now, it feels like a pure copy paste job where the agreement has been compiled after looking at several other platforms agreements referring to certain sections which don't exist at all.

In below screenshot, where they refer to Clause 7.3, it doesn't exist. Moreover this agreement is not mandated to be signed by the investor at all by Falcon.

Also, the usage of logo of the big anchors looks unauthorized and if someone at these anchor company finds out, I am sure there will be repercussions for Falcon.

In short, in my opinion you don't have any legal recourse against Falcon if a deal goes wrong.

#5: Transparency & Deal Details

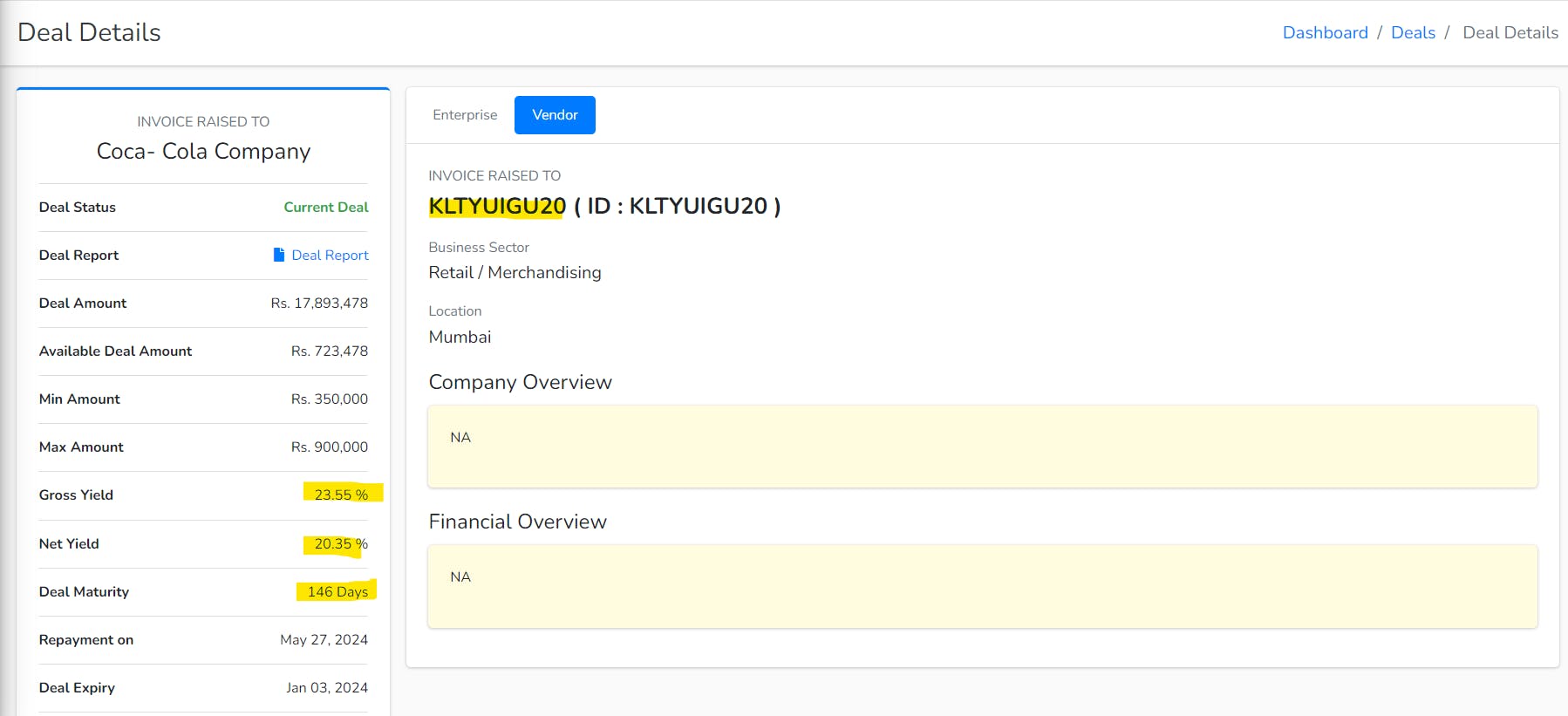

Let's talk about the below example deal which is available at 23.55% if an investor invests minimum of ₹3.5L in the deal. The Net Yield is 20.35% and deal tenure is 146 days.

Falcon has given all details of the Enterprise which is Coca-Cola so that the investor thinks that the risk lies with Coca-Cola and how will Coca-Cola not pay because it's such a big conglomerate and financially stable.

But they will never show any details of the Vendor where the actual risk lies. Invoice Discounting is generally giving money to the vendor who has raised invoice to the enterprise. So even if the enterprise pays and vendor defaults your money is stuck. The recourse or responsibility is always on the vendor and they have conveniently not given any info about that. Some of our community members have asked about this to Falcon RMs but they have never provided vendor details suggesting confidentiality as a reason.

So how can you be sure that there is another counterparty in the background actually receiving this money and utilizing it, nothing is mentioned in the agreement as well.

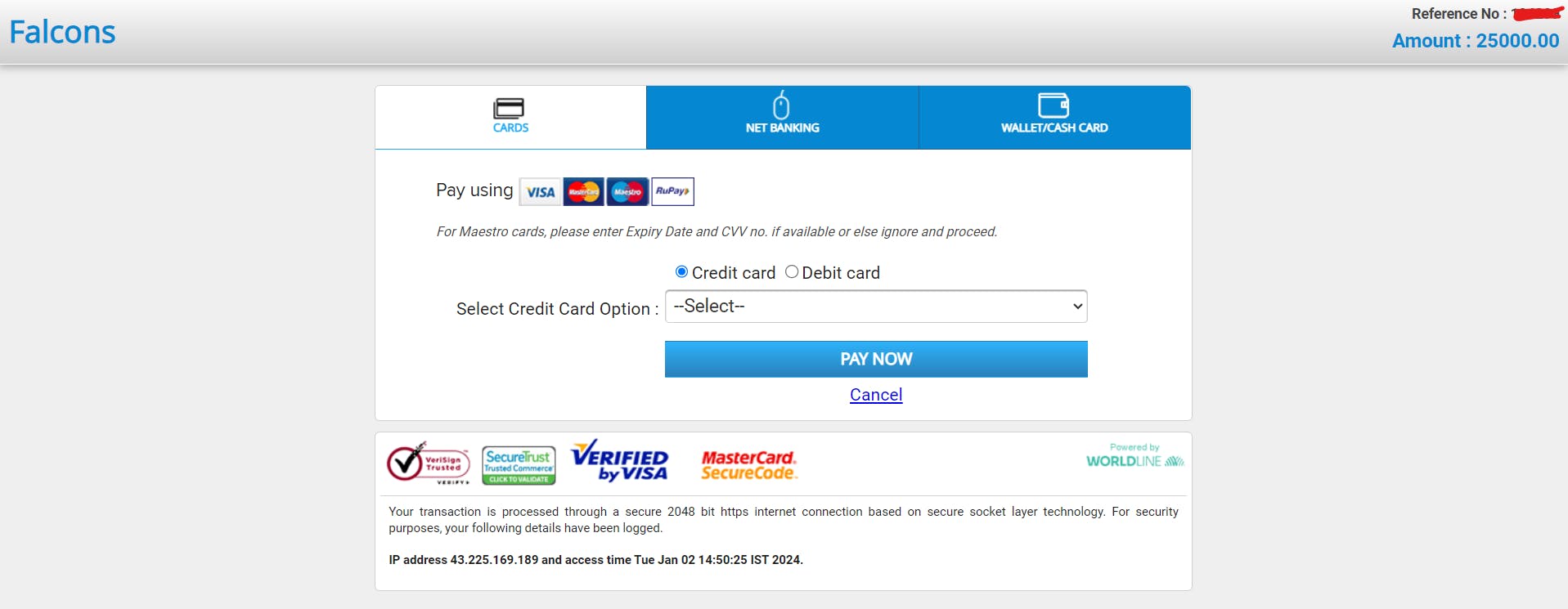

#6: Use of Credit Card for Investment Purposes

Invoice Discounting is considered as an alternative investment product and Falcon is the only platform allowing users to use Credit Card to fund invoices. Imagine making an investment with money you don't have? SEBI has clearly banned this practice and any platform accepting CC as an investment option maybe breaking the law.

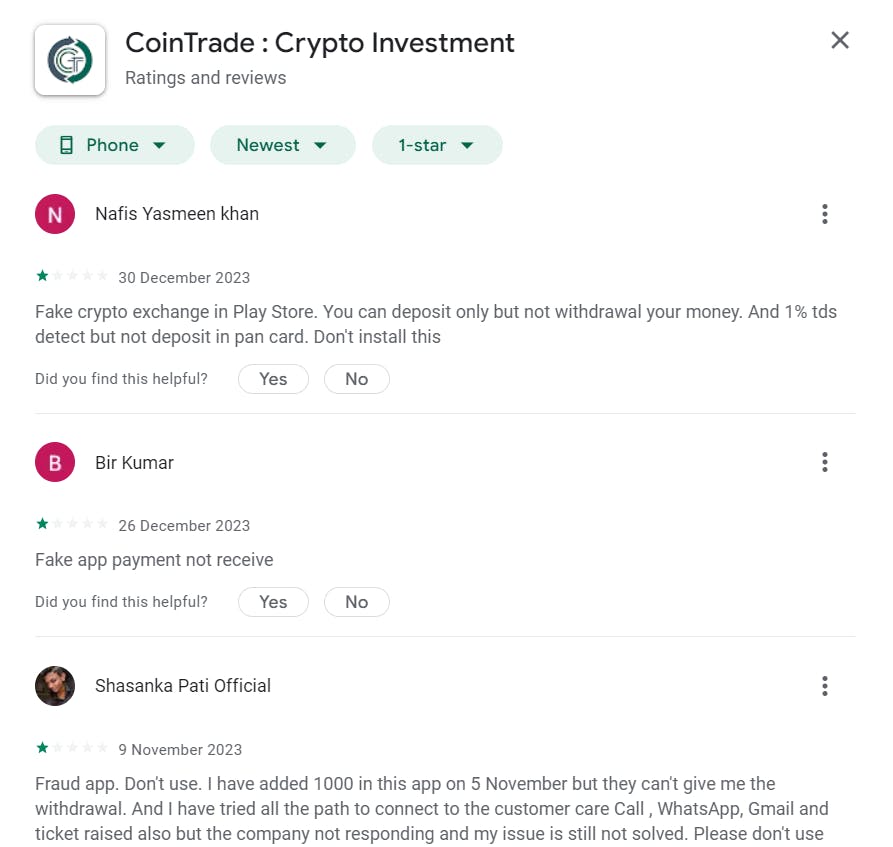

#7: Crypto Trading Application by Related Firm

Falcon Capital Ventures Pvt Ltd. which was formerly known as Falcon Wealth Management India Pvt. Ltd. has an application on iOS AppStore and Google PlayStore by the name of CoinTrade which claims to be a crypto trading app similar to the likes of CoinDCX, WazirX, etc.

I didn't download the docs of this company from the MCA but a quick check across other platforms suggests this company's purpose was to sell software for educational purposes or network-based solutions. I have no idea why are they maintaining a Crypto Trading App.

The app is rated 3.5 but if you really read the reviews, most of them are fake. Most of the 1 star reviews have a common theme, you can deposit money into the app but you can't withdraw it.

Given the negative reviews and company's main agenda as per MCA, we consider this as a red flag.

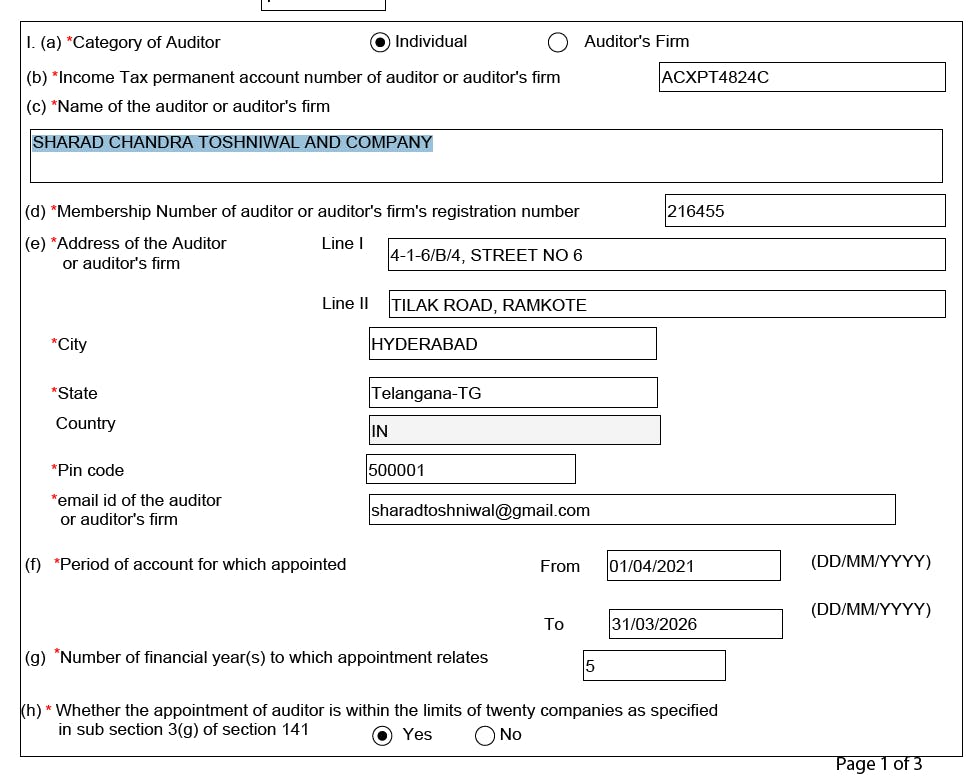

#8: Auditor Changes in Last Financial Year

As per the filings with the MCA, CPFPL has changed it's auditor 3 times in relation to it's filings for last 3 years. This can be concluded by the ADT-1 form that needs to be filed with the MCA.

On 8th March 2022, SHARAD CHANDRA TOSHNIWAL AND COMPANY was appointed as an auditor for year 2021-2026

On 21st Nov 2022, just 8 months later, Pallerla and Associates which is based out of Vishakhapatnam was appointed as an auditor for 2022-2027

On 3rd Dec 2023, the auditor was changed again to Neelima & Co backdated to start from 01/04/2023 to 31/03/2028.

I personally don't think the auditors were charging too much money that the company changed them for financial reasons, but I think the auditors resigned or were not comfortable with signing the books of the company and I consider that as a red flag.

Conclusion

These are all the red flags we could identify at this stage, I cannot be sure on how legit the overall business is, but given the above red flags, I would think 100 times before putting my money on this platform even if they offer me 50% IRR returns.

Returns are worthless if you end up losing 100% of your initial principal. Again, this article is for information purposes only and you are the best person to make a decision whether you would like to invest in this platform or not. ALT Investor has no formal recommendation on this.

Lastly, many thanks to all our community members who helped us corroborate various red flags and Samparn Patra's Tweet which gave me lots of clues on where to look.

If you would like to join our Whatsapp Community, please apply via this link.

If you would like to get notified of deals in Alternative Investments directly from platform owners, please join this Whatsapp Channel where your details stay anonymous.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.