Exploring Invoice Discounting: A Smart Alternative Investment Option in India

A guide for Indian Retail Investors!

Invoice discounting (ID) is currently one of the most popular alternative investments in the Indian retail investor's market, largely due to the numerous platforms promoting this product and the shorter time horizon it provides, which attracts many people. This product is already very famous in the institutional investor's space since RBI launched TReDS and the government has been very active in promoting this way of financing invoices and reducing the burden on MSMEs.

To be completely honest, I also like this product, so much that I wanted to launch my own platform to discount invoices, but you know it's not always that easy.

On a serious note, I have invested a portion of my wealth in it, as it is easy to comprehend and the risks are clearly defined. While doing my research, I realized there is already a lot of good unbiased content out there on this topic so I will keep this blog to the point and mention all other sources at the end of this blog. Even after reading this if you still have any questions, feel free to send me a message via this link or mention it below in the comments.

1. What's Invoice Discounting?

Invoice Discounting (also known as Bill Discounting) is a product which gets generated when a business sells its unpaid bills (on delivered products) to an intermediary for less money. The business does this to get cash quickly so they can

pay their own suppliers and employees

fulfil other orders

re-invest in the business to maintain growth momentum.

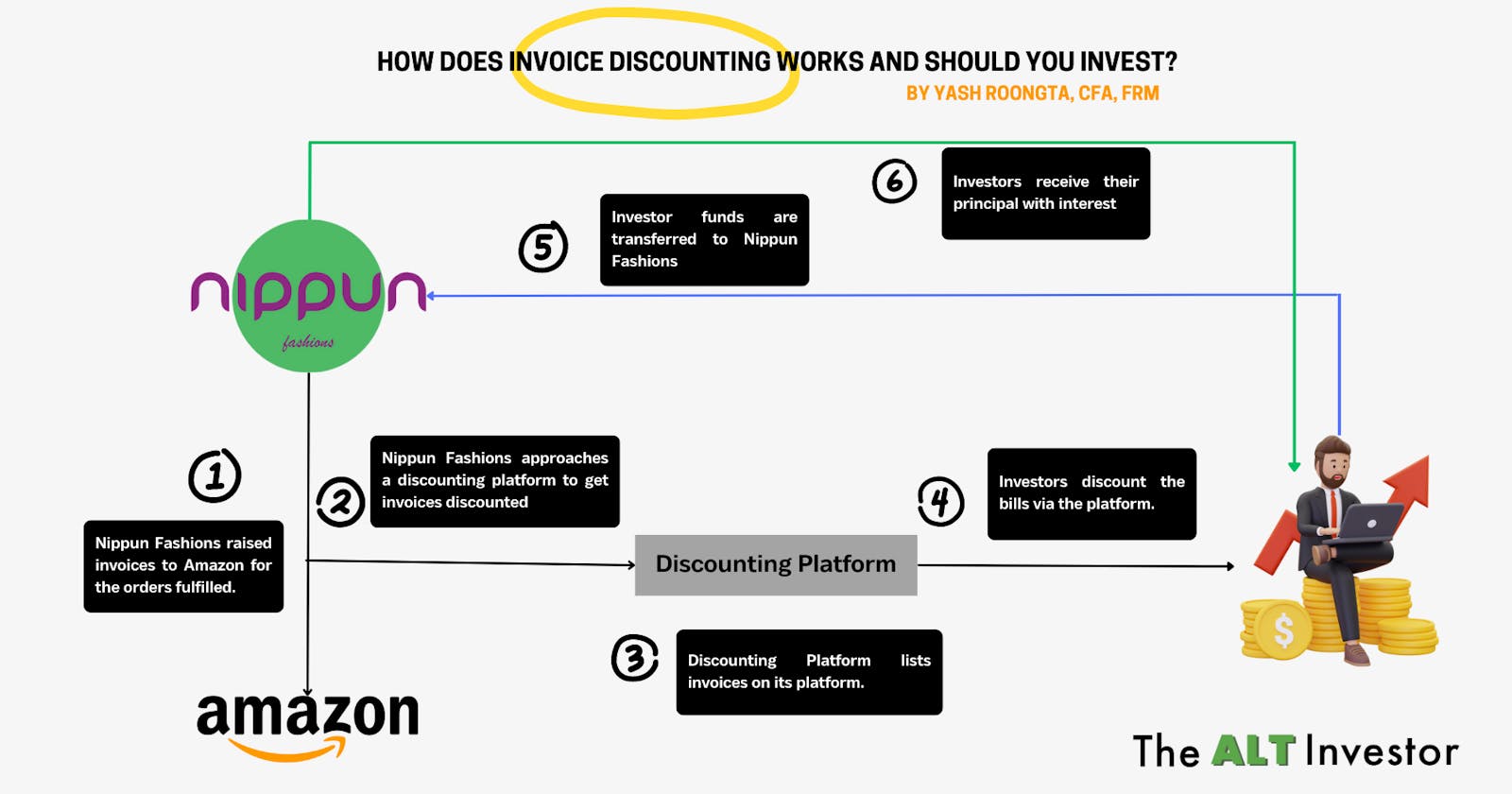

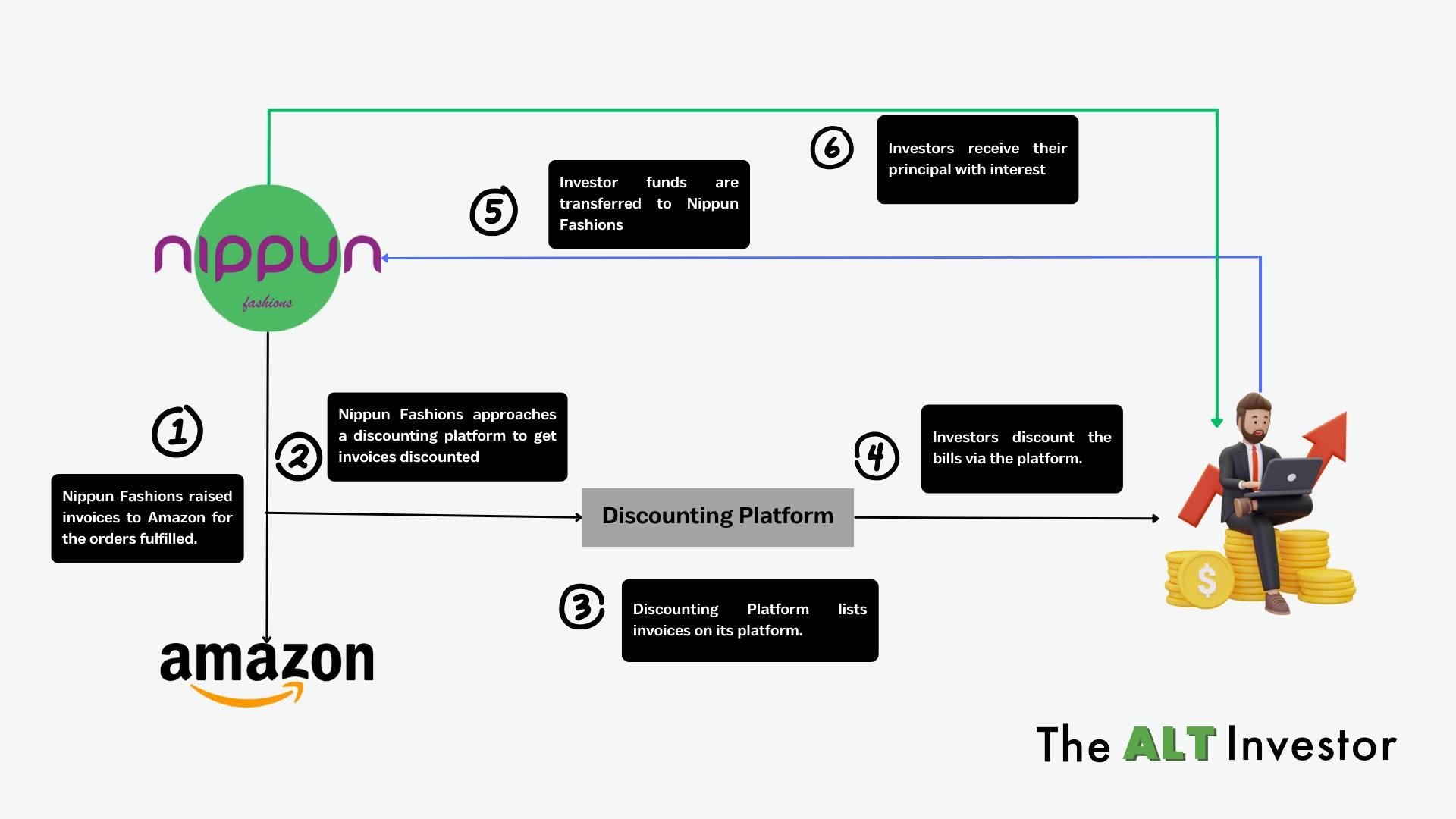

Let's take a very simple example which we have shown in our cover image:

Nippun Fashions is an MSME company that supplies fashionwear on Amazon. Since Amazon is a much larger company, it can set its own payment terms for Nippun. Their policy is to release the payment only 60 days after the goods have been delivered by Nippun.

For instance, if Nippun sold 100,000 INR worth of goods to Amazon on May 5th, 2023, they could expect payment by July 5th, 2023. However, Nippun faces a cash crunch today as it needs to fulfil other orders, pay its own suppliers, and cover salaries. To address this, they approach a discounting platform to finance the Amazon invoice.

The discounting platform showcases this deal on its platform for a fixed return. Investors collectively pool 90,000 INR and pay Nippun Fashions, who is satisfied with the arrangement. Sixty days later, when Amazon releases the payment to Nippun, they repay the full 100,000 INR to investors in proportionate amounts as specified in the discounting agreement. This allows the investors to earn a good return on their investment in a short period of time.

Many people wonder why Nippun Fashions doesn't approach a bank or NBFC to finance this deal. There are several reasons:

Banks have their own credit assessment frameworks, which are not very flexible. They can only take on certain levels of risk for specific sectors.

The bank might have already provided a working capital loan to Nippun Fashions, which they have used to finance other orders.

Nippun Fashions doesn't want to rely on a single financial institution for its monetary needs; they aim to diversify its liabilities.

2. Why you can think about investing in Invoice Discounting?

There are multiple reasons, the most important ones being:

Diversification of your portfolio. Invoice discounting is not highly correlated with stocks/mutual funds unless the invoices are of a finance firm whose business is highly dependent on the markets.

Shorter time horizon, hence less liquidity risk. Most invoices generally range between 30-90 days.

Higher Returns. Generally, invoice discounting can offer fixed returns anywhere between 10-24% interest dependent on other risks which we will talk about next.

3. Risks associated with Invoice Discounting

Keep in mind that higher returns typically come with higher risks. Some financial influencers may promote invoice discounting as being as safe as a Fixed Deposit with a bank, but this is not the case. No one would willingly pay a higher interest rate for the same level of risk. Therefore, invoice discounting carries the following risks:

Credit Risk: This is the most significant risk that is crucial to understand. In the example provided, we need to assess the credibility of Nippun Fashions and Amazon, the current market cycle, the possibility of Amazon not being able to pay back Nippun, and the scenario where Amazon pays back Nippun but Nippun defaults and fails to repay you. In such scenarios, you risk losing all your investment.

💡Also to note that invoice discounting products are considered as Operational Debt, so if the company goes bankrupt, this debt comes 3rd in line after Secured Debt and Unsecured Debt.Fraud Risk: You need to determine whether the company is issuing authentic invoices or fabricating them to raise funds and fulfill its capital requirements. If the invoices are fraudulent, there is a possibility that you won't recover your investment, and you may not want to deal with the complications of pursuing legal action.

Liquidity Risk: Although invoice discounting is a shorter-term product, it is possible that due to a small issue somewhere in the supply chain, the supplier is not able to pay back its investors for a couple of days/months. That creates a liquidity risk for the investor who might be relying on that money to meet other personal obligations.

Dispute Risk: This risk arises when the buyer and supplier engage in a disagreement over unmet terms and conditions in their agreement, resulting in the supplier not receiving payment and, consequently, you not receiving it either. This creates uncertainty regarding if and when you will receive the money.

Co-Mingling Risk: This risk can arise when a buyer and seller collaborate to create false invoices, giving the appearance of conducting legitimate business when they are not. This is commonly seen in related party transactions, where a parent company, Company A, might issue an invoice to its subsidiary, Company B, and have it discounted without providing any actual goods or services.

Same Invoice Discounted multiple times: Although the actual risk of this is low, however, some companies might get the same invoice discounted on multiple discounting platforms or via offline channels.

I hope this provides you with a clear understanding of the associated risks. It is crucial to invest in invoice discounting deals through reputable platforms that are aware of all the risks mentioned above and actively take measures to minimize them. Additionally, you should conduct your due diligence for peace of mind.

4. List of Invoice Discounting Platforms

India now boasts a variety of fintech platforms that enable you to invest in attractive invoice discounting deals. I have ranked them below based on my own due diligence, opinions, and preferences regarding these platforms. Please note that some links include referral links, as this provides you with an incentive when you sign up and invest, while also supporting the operation of this blog. However none of the referrals ever influenced the writing on this blog.

Platforms I have personally used:

altGraaf (Click here for referral): This is my preferred platform, given how strong their whole team is and the level of vetting they do before onboarding any company on their platform. This article was inspired by their webinar which you can access here. The minimum ticket size is generally 95,000 INR.

BetterInvest (Referral Code: AW7JTH): They have a unique approach and exclusively handle invoice discounting for reputable movie/OTT production houses. The founders are also from the industry, which adds more credibility to their operation. They have offered approximately 18% on every deal so far, but keep in mind that higher returns are often accompanied by higher risks. The minimum ticket size varies between 50,000 - 1,00,000 INR. We have written a detailed blog about it, feel free to check it out.

Tyke Invest: This is my least preferred platform but it appeals to a lot of investors as the minimum ticket size is as low as 10,000 INR. However while evaluating deals on their platform, I have found fundamental due diligence issues in the companies who are coming to Tyke for Invoice Discounting giving me doubts on their due diligence process.

Platforms I have not used but exist in the market:

I have personally not used the below platforms so don't have an opinion, but I plan to review these platforms in detail in upcoming blogs.

Grip Invest (via a product called InvoiceX)

5. Bottom Line?

In conclusion, invoice discounting is a popular alternative investment option in India that offers diversification, shorter time horizons, and potentially higher returns. However, it also carries various risks such as credit, fraud, liquidity, dispute, co-mingling, and multiple discounting risks. Investors should conduct thorough due diligence and invest through reputable platforms to minimize these risks and maximize returns.

Hope you enjoyed the article, if you think there is something factually incorrect or if you know of any other platforms offering invoice discounting for retail investors, please send me a message here or email me at yash@thealtinvestor.in

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically, if you are a Tradewithpython subscriber, you know we don't spam.

Lastly, if you like our work, please feel free to sponsor us via Hashnode Sponsors or Buy me a Coffee by clicking here or the button below. And if you would like to speak to me or get my opinion on anything related to investments/finance/algotrading, schedule a call with me on Topmate.io by clicking the below image.

Thank you for reading and hope to see you in the next one!