Usually, we try to start our article with a great storyline, its so that people can relate to the product with real life incidents or examples. But in today's article we will directly jump to the crux of the discussion. It's because this investment product is a quite a strong cocktail of traditional and modern ways of investment, so it's best to gulp it down in one go. So, let's get started with this investment product which is known as Real Estate Tokenization.

Blockchain & It's Use in Tokenization

So, remember how I said mix of traditional and modern investment practices?

The traditional side in real-estate tokenization is your usual FRE (Fractional Real Estate) activities that is finding properties with:

Good Rental Yields.

Managing and maintaining the property.

Signing stamp duty agreements.

Finding tenants and reselling the property at the time of deal maturity.

The modern side actually refers to the technical infrastructure which is based on blockchain. I know blockchain, crypto, bitcoin blah blah, I might have lost half of my audience there, but let me attempt to break it down for you.

Blockchain is essentially an online ledger where all the transactions related to property (SPV) is reflected. Why Blockchain? We will answer this question shortly. But the more important thing is What is Blockchain? Think of it this way, if you were to download a cashflow statement from a company's website, you would see the numbers which are entered by the company in that sheet. These numbers can be changed or retyped as per the company's convivence. Obviously, this is illegal, and a crime as the books have to be audited by CA, but there is no real measure to prevent this in the first place.

So, in Tokenization, the platform uses a blockchain ledger, which automatically records all the transactions of the SPV. These transactions cannot be changed or masked by any single user, thanks to the technology itself. Because the entire data of the ledger is stored into various individual blocks, and these blocks are stored on the device of the investors in small files. The financials of the SPV, in addition to it being part of ROC Filings is formed by a chain of these blocks on different devices, hence blockchain. This way, each investor has access to real-time financial data, and the data cannot be altered by any party. Now, that we have a basic understanding of how blockchain is used in recording transactions (Also known as Decentralized Finance - DeFi), let's move on to Tokenization.

How Does Real-Estate Tokenization Work?

So, the process of tokenization starts with the traditional Fractional Real Estate investment route. Here, the Tokenization platform would setup a SPV, such as LLP or Pvt Ltd Company. The platform would then raise money from investors into this SPV. The fundraise could be purely equity or a mix of equity and debt. If the investment is through pure equity, the Investors become the shareholders/partners in the SPV, whereas when both the components are involved, each investor becomes shareholder/partner in the SPV as well as a capital contributor in the books of accounts. The Debt + Equity structure is widely used in the industry.

There are primarily two types of tokenization models operating in this space, let's talk about them one by one.

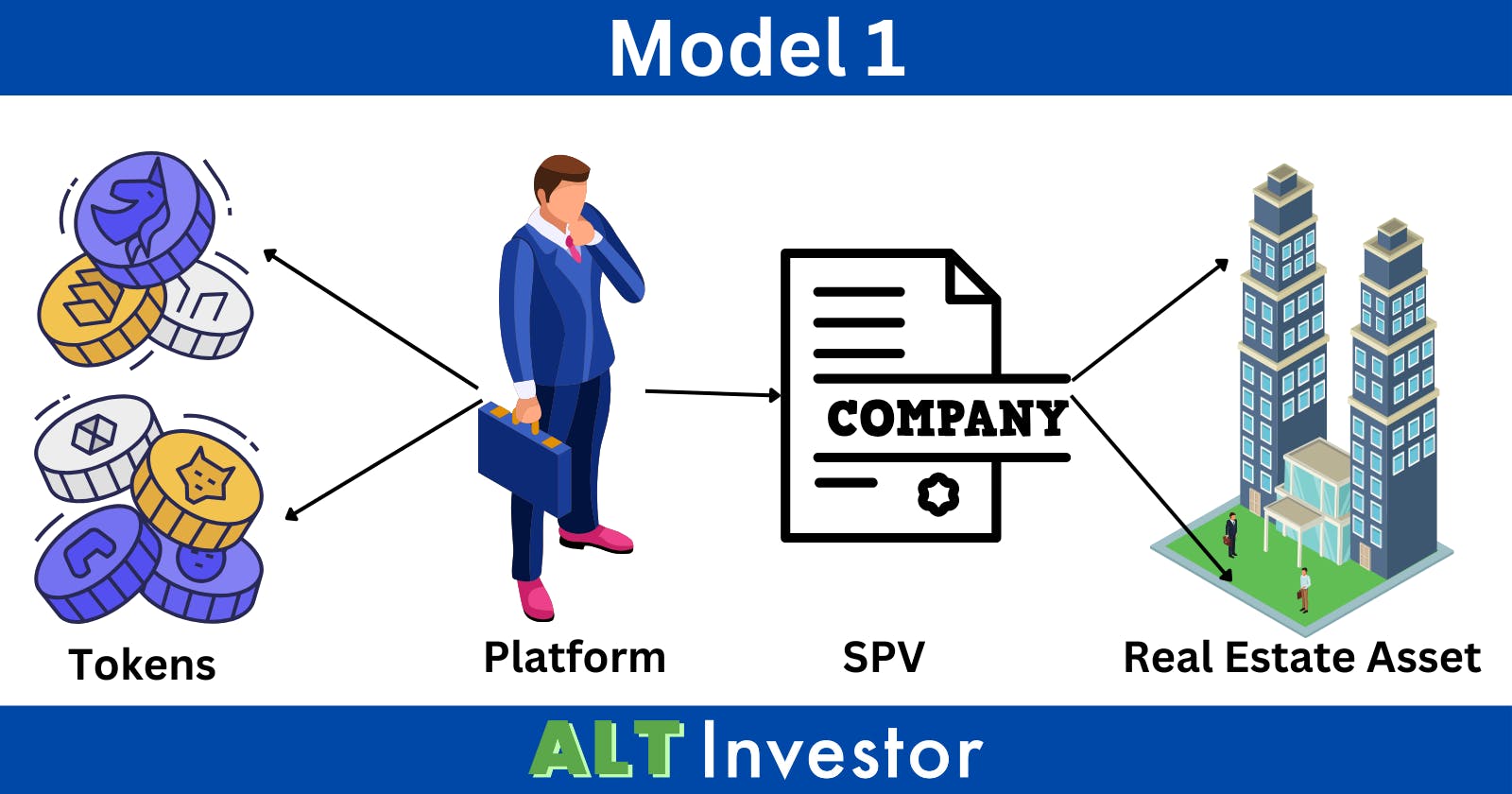

Model 1 (Platform Issuing Tokens)

In this model, a platform or platform owner would setup a SPV, take the investors money and pool it into a SPV and then purchase the real estate property in question. After this, the platform will independently issue tokens which they will claim to be linked to the asset in the SPV but are not exactly linked.

The platform has issued these tokens (not the SPV), so technically there is no underlying asset here. Although the platforms owns 100% stake in the SPV, it doesn't give it the right to independently issue tokens. This is not at all a recommended model to invest in. Because, if some dispute/defaults happen, the digital token contract in no way be enforceable under the law. It is equivalent to other digital assets like Bitcoin, Dogecoin, etc where there is no real underlying.

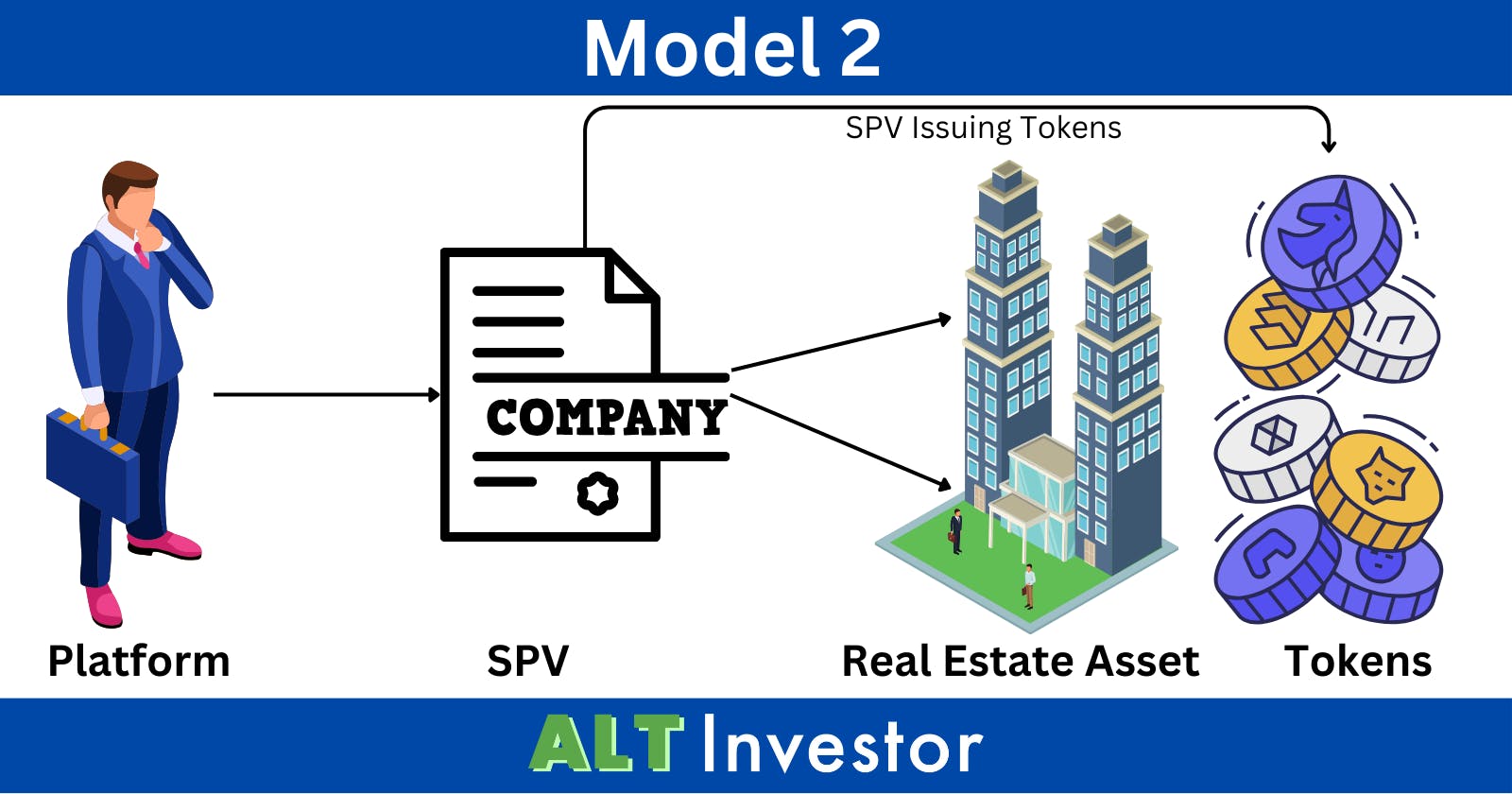

Model 2 (SPV Issuing Tokens)

In the second model, the platform or platform owner would setup an SPV where investor money will be pooled and a real estate asset will be acquired. The SPV would then go ahead and issue the tokens on it's own books where the underlying will be a debt instrument.

Here as an investor, you become a stakeholder or a capital contributor to the SPV which then issues you tokens. This is a much safer and recommended alternative as compared to Model 1 since there is an actual underlying to the tokens issued which will be enforceable in the court of law if the agreements are done properly.

We will primarily talk about the Model 2 (SPV Issuing Tokens) in this article given it's a safer and recommended model. Let's understand with an example, but first you need to understand there are 3 primary stages of acquiring an asset and tokenizing it.

Private Round where generally investors with minimum of ₹8-10L participate. Here 20% of your investment size is used for equity stake in the SPV and rest 80% as debt.

Secondary Round where the debt piece of your stake gets issued to you in the form of tokens. These tokens can be sold in the private secondary market of the platform to other investors.

Third Round is where tokens can actively be traded between investors on the exchange in real time.

Now the above maybe slightly different for each platform, but the primary concept will be the same if the platform is operating via Model 2 Framework.

Primary Round (Like a Pre-IPO Round)

Let's say the platform decided to buy a 10,000sq ft shop into the SPV which is located in Bandra, Mumbai. The cost of the property is ₹15Cr, which translates to ₹15,000 per sq foot. Let's say the SPV is an LLP and it raises the ₹15cr via mix of debt and equity (80% and 20%). So, when an investor invests ₹10L into this deal ₹8L goes toward the debt component and ₹2L is the equity component where you get a partnership stake in the SPV.

The debt component (debenture) is then broken into very small pieces representing 1Sq. Foot of property, so in our example, this will be ₹15,000. These small pieces are then tokenized by the SPV and allotted to you by the platform as per your investment size.

Any rental income from the property will be distributed to the investor in form of interest (for the tokens held) and as dividend income (for the partnership rights).

Any capital appreciation from the property will be distributed to the investor as an appreciation on the underlying debenture for the held tokens and as an appreciation of partnership stake for the held partnership rights.

Your stake + capital contribution is duly registered with the MCA (Ministry of Corporate Affairs) at this stage and most platforms wouldn't allow you to sell your equity stake for a specific lock-in period due to various costs and legal complexities involved.

Secondary Round (IPO Round)

Investors who participated in the Primary Round can now list their tokens (which represent the debt part) of the deal on the platform exchange for sale to secondary investors who may not be able to participate in primary round due to high ticket size constraints.

If you are an investor participating in this stage, please note, you do not get partnership rights in the SPV, you rather become a capital contributor to the SPV and this change will not be immediately visible at the MCA portal but the accountant of the SPV will make a note of the change in ownership and accordingly file it with the MCA on a quarterly/annual basis. This change in ownership will also be registered on the blockchain so there's no confusion on this to any party involved.

This round is generally limited to a particular time period (like an IPO) and the platforms might also restrict how many tokens can be sold by the primary round investors in this round. It will all be mentioned in the agreements.

As a secondary round investor, here is how your tax will work:

Any rental income from the property will be distributed as interest on the underlying debenture and will be taxed per your income tax slab.

Any capital appreciation when selling the token will be considered as a capital gain on the underlying unlisted debenture and will be taxed accordingly.

Third Round (Listing on Exchange)

In this round, the token gets listed on the private exchange of the platform and can be bought and sold by any investor who wishes to. The price of these tokens will keep on changing on the exchange depending upon the actual value of the underlying assets, accrued rent on the property, demand supply, etc. We expect some platforms to publish their token pricing methodology soon which will help you identify the fair prices of the token.

When you buy the token in this round, you again get the exposure to the underlying debenture itself and are not given any partnership rights in the LLP. The taxation in this round will work similar to Second Round.

The only difference in this round is that you can buy/sell tokens at a price you deem to be appropriate. The platform will charge you some transaction fees which will cover some basic charges plus the stamp duty charges of buy & sale agreement deed of the debenture that gets executed behind the scenes.

Do We Really Need Tokenization?

So now the question is, why do we need this method of investment? The normal way of investing in fractional real estate seemed just fine. I mean to say, there are many players entering the FRE space, investors are getting cozy with this investment and yields are just about fine, so why do we need this new concept? To answer this question, we actually got in touch with one of the leading industry players:

Transparency: As we explained, blockchain is an online ledger, and the transactions are visible to all the Investors in real-time. Infact some platforms allow you to see the cash-flows and balance sheet even pre-investment. And as mentioned, these transactions cannot be altered or hidden by the investment platform.

Lower Operational Costs: Using blockchain to record transaction, platforms save on several transaction costs related to escrow, banks etc. This also helps them save some cost on compliance and disclosure, as all of this is already visible on the investors, all these cost savings are ultimately passed to investors in form of higher returns.

Decision Making & Control: All investors are given voting rights. The day-to-day transactions may not necessarily require a voting from investors, but any major decision that needs to be made by the platform in relation to the property, will require a voting from all the investors.

Liquidity: In Traditional FRE, it is very difficult to withdraw your money from the deal, as you might not have a ready buyer on the other hand with the ability to invest ₹10-25L , or there may not even be an option to withdraw the capital (Without a massive haircut). In tokenization, you can easily sell your tokens even in small qty on the platform itself, if there are other ready buyers.

Small Ticket Size: Because there is a lot of liquidity and ease of investment, platforms can afford to have small ticket size, when compared to traditional FRE platforms. The ticket size can start from as low as ₹5,000 to ₹1 Lakh, while in traditional FRE, it can go range between ₹10-30 Lakh.

Lending / Collateral: And lastly, these tokens can be used as collateral to take loans. New age NBFCs will tie with the platform to offer loans in exchange for these digital tokens. So you can enjoy your rental yields and have access to credit during your investment.

Challenges to Tokenization

There might be a few challenges with this investment option. Let's divide the issues into 2 parts, one is regulatory and the other one is tech.

The regulatory part is still a bit grey, as the industry itself is quite nascent, but we observe the picture is slowly changing. Currently, Telangana is actively working in this space and has recently launched an asset tokenization framework for all the platforms. But given that Telangana is a state government, these frameworks will be more of a consultation paper rather than actual regulation. For a solid regulatory framework, we will have to shift our eyes to GIFT City, where the IFSCA is all set to launch tokenization regulations for all the players operating in the IFSC. The regulatory challenges generally pop-up in the area of smart contracts (Digital contracts), KYC and Dispute Resolution.

The smart contracts needs to be full proof and secured to protect the rights of investors. This means, even if the things go wrong, the right of ownership is protected. The KYC for the wallet should be a mandatory standard for operations. The process of KYC should also be secured with all the right data protection measures in place. And lastly the dispute resolution, it is very much possible that our current legal system may not have provisions to settle disputes related to VDA (Virtual Digital Assets).

All of the above problems can be solved if there is a regulatory framework established by the center or there is a separate body/department which is made within SEBI to oversee asset tokenization. Because when we are dealing with physical assets such as real estate, or things such as cars or trucks for leasing agreement, it is still simple to practice tokenization. But if we were to include securities, such as debt and equity instruments, things might get complicated.

Now coming to some of the technical challenges. Firstly, the entire tech aspect may go over the investor's head, so this entirely depends upon how trustworthy the platform is. The process of selecting a blockchain network is quite important. The blockchain platform networks will determine the data security, transaction speeds and overall operations of the blockchain network. Platforms will also have to publish their algo for pricing the token to build some trust within investors.

Risks of Tokenization

There are other risks that investors should be aware about before investing into this product. Most of these are common with FRE risks.

Regulations: One of the biggest risks is the absence of an elaborate regulatory framework. This entire sector is unregulated, and only recently SEBI has considered placing FREs under small and medium-scale REITs. Thus, the investors have to choose a trustworthy tokenization platform.

Credit Risks: It is possible that the property tenant may default on the rental payments, so the platform will have to pursue legal actions. During this period investors will miss out on the returns.

Unpredictability of Cash Flows: Several factors affect the returns of the underlying property, during COVID-19, for example, commercial real estate returns were dismal. Similarly, during the off-season, the returns from luxury resorts can be quite low as well.

Platform: The actual risk management and operational activity such as maintenance, finding tenants, collecting rent etc. is overseen by the platform or the property management company hired by the platform. Thus, it is important for investor's to choose the tokenization platform clearly.

Platforms in Real Estate Tokenization Space

We haven't personally invested in any of these platforms yet, but here is a comprehensive list for you to pick and choose from:

All these platforms will have some form of pros and cons, we aim to do deep dives into each platforms model in the coming weeks. Please do your due diligence before investing or raise your queries in our Whatsapp Community which you can join here.

Conclusion

So, to answer the two important questions - Is it a Gimmick and Should You Invest? To answer the first one, it might not be a gimmick after all. When I first looked at the concept without understanding the actual process and benefits, my thought was, "why do these people keep complicating investments in the name of alternate investments". But after understanding the entire process, I can say that there is quite a big market for tokenization, which may grow quite steeply in coming years. (Thought I cannot comment on how sustainable it is)

I for one am not a big fan of blockchain or crypto, because I simply do not understand the tech, and I know many who have a similar thought process. But the hype for tokenization is increasing. Even in our ALT Investor Community, people are talking about real estate tokenization and are willing to explore this option.

But before investing, it is important to note that you are not really investing in a digital asset, rather the underlying asset. So, at the end of the day, the majority of risks will be of the FRE property and not of the token itself. If you are someone who is looking for steady cash-flow, lower risk, asset backed investment, then you can certainly explore this investment option especially with the zero tax advantage on capital gains. But if you are someone who is looking to invest in crypto and NFTs after looking at massive returns, you are in a completely different and wrong place.

Lastly, we would like to acknowledge that this was a difficult topic to write upon and we have to do multiple re-writes of this piece and our knowledge may still be incomplete, so it would be best for you to understand this asset in more detail directly from platforms before making your investment.

We hope this article added some value to your knowledge around tokenization the real estate space. If you have any questions on this piece or any suggestions for us, please join our Whatsapp Community to discuss those. You can apply here.

If you are someone who wants to get ALT deals across platforms in one single channel, join our Whatsapp Channel here to directly hear from the platform owners.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Lastly, if you like our work, please feel free to sponsor us via Hashnode Sponsors.