Startup CSOP Investing: Is It the Right Choice for You?

Exploring CSOP Investment Opportunities in India

The retail alternative investment sector in India has experienced significant growth in recent years due to the introduction of various new mechanisms and instruments. (especially after the launch of Shark Tank India) These options allow investors to gain exposure and achieve high returns by capitalizing on the growth of startup companies.

While this is highly promising for the overall startup ecosystem, there is a considerable amount of miscommunication aimed at attracting retail investors by presenting them with higher IRR returns without adequately explaining the risks.

This blog discusses CSOPs, which are the fastest-growing method for startups to raise funds and inflate revenues (more on that later).

1. CSOP (Community Subscription Offer Plan)

To explain simply, CSOP is a contractual agreement*(not an instrument) between you and a company that *promises (yes promises, does not guarantee) to offer the following two benefits:

A. SAR (Stock Appreciation Rights): SAR gives you an opportunity to receive a value equal to an increase in FMV (Fair Market Value) of the company at the time they choose to buy back its CSOPs. There is no fixed timeline for this, it completely depends on the company on when they choose to buy it back.

B. Community benefits such as:

Discounts/offers on products or services the company raising money offers.

Exclusive company events access.

Freebies

Ability to participate in Beta Launches

Have informal chats with the founding team.

CSOP contracts resemble derivative products, which are prohibited to raise money unless they are traded on a recognized stock exchange.

2. It sounds confusing; what exactly is a SAR?

When I first came across the concept of CSOP and SAR, I first thought that SAR must be a financial instrument (like equity) that would give me some sort of stake in the company and I would finally be able to call myself an angel investor!

Not this angel though! But I also invested in one CSOP out of FOMO where one of the leading platforms was demonstrating limited-time deals! Only after executing the transaction, did I read the agreement in full to realize I own nothing.

SAR does not give you any physical stake in the company, no financial instrument is ever exchanged. It is just a contract on a piece of paper. The company can very well choose not to honor it.

You don't share any profits or dividends of the company (since you don't hold any equity)

In the future, the company may choose to buy back your CSOPs or SARs at their discretion and settle in cash or stock based on their preference. However, consider this: why would a company offer you equity when they can pay you at a lower valuation in cash and retain the equity for themselves?

Generally 1SAR = 1000 INR worth of investment but this can differ from platform to platform so please pay attention.

3. Let's take a look at a sample CSOP contract

The below contract is a sample contract issued by TykeInvest and made publicly available on its website here:

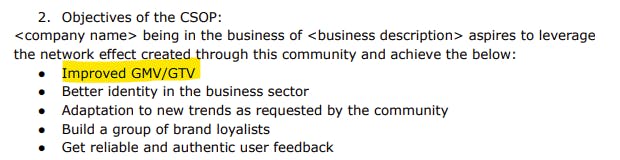

In the agreement, the first point mentioned as an objective of CSOP is "Improved GMV/GTV" This is a big red flag because companies who raise money via CSOPs show it as revenue (net of 18% GST) on their books and create a provision for SARs.

However, consider this carefully: isn't it possible for a company to artificially inflate its revenues to attract more future investors and raise additional funds while neglecting the development of a sustainable business model? Of course, not every company attempts this, but the point I'm making is that even the foundation of investing is flawed in this case.

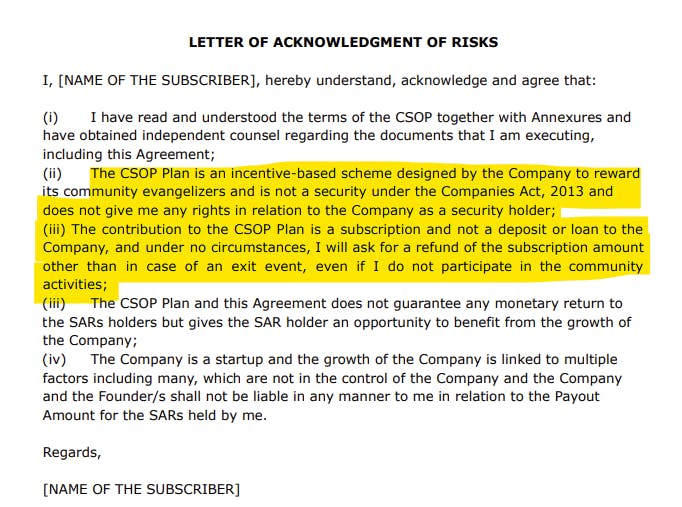

Point (ii) mentions CSOP is an incentive-based scheme and not a security under the Companies Act, 2013 which means it is neither regulated by RBI/SEBI. (Are the alarm bells ringing?)

Point (iii) mentions CSOP is a subscription.....wait I thought I was investing to gain returns from the future growth of startups not subscribing.

In the agreement, there is a mention of the Valuation Cap and Discount Cap concepts, which determine the value you receive if the company decides to buy back CSOPs in the future. However, I believe it will never reach that stage.

4. Other Red Flags to Consider

You Don't own any Voting Rights in the company, you are just another contract holder for them.

There is significant Regulatory Risk since SEBI/RBI might crack down on such contracts and shut them all together, what would happen to your CSOPs then if the company is not in a position to pay you back?

There is no flexibility during an exit, the company decides when to give you an exit, and whether to give you cash or to give you stock.

There is no financial incentive for the company to give you an exit as there is no defined end date to the CSOP contract.

You are investing blindly here based on company credibility, you don't have access to any financial metrics, order book view, etc which can give you more info.

5. What are your exit options if you hold a CSOP?

A. Voluntary Exit

The company decides to give you an exit and pay you the equivalent of SARs you hold in CSOP multiplied by the Fair Market Value of the company.

Example: You invested 5000 INR in company XYZ at 100Cr valuation and were allocated 5 SARs. After 2 years, the company is now valued at 200 Cr and has finally decided to buy back CSOPs, you will get:

$$(Invested Amt * No. of SAR * New FMV)/Old FMV = Current Contract Value$$

$$(1000 * 5 * 200)/100 = 10000 INR$$

However note, any gain from CSOP will be considered as Income from Other Sources and you will have to pay tax on your tax slab rates. There are no capital gains involved here since you are not dealing in securities. By any chance you are in the 30% tax bracket, you will pay 1500 INR as tax here netting 3500 INR as profit which may sound lucrative but tell me how many startups are successful? It can as well go to zero, of course, you don't have to pay taxes then (at least something better)

B. Involuntary Exit

If your invested company gets acquired, or merged, or if your stars are aligned, goes for an IPO, they will have to mandatorily end your contractual agreement and pay you the fair value at the time.

If your stars are not at all aligned, the company might go bankrupt, rendering them unable to fulfill your contract with them, and causing you to lose your money.

6. Platforms that allow you to invest in CSOPs?

After taking all the risks into account, if you still wish to invest in CSOPs, you can utilize the following platforms. Please note that their inclusion here does not necessarily imply endorsement; in fact, we plan to cover these platforms in greater detail in upcoming blog posts.

Sateeq (However, they have not launched a new campaign for some time now.)

That's all I could find at the moment. If you know of any other platforms that facilitate CSOP investing, please mention them in the comments or drop me an email at yash@thealtinvestor.in

7. Bottom Line?

There are no free lunches.

Do not run behind higher returns without completely understanding the risks. CSOPs are extremely complicated and fall in a grey area. Big Boss SEBI is watching and in my personal opinion would even crack down on some platforms which are acting as quasi-exchanges and issuing these derivative-type instruments.

CSOPs have only emerged in the market within the last 2-3 years, and so far, we haven't heard of any startups providing an exit to CSOP holders. I recommend waiting and observing how the current CSOP deals unfold. Avoid giving in to FOMO, which could lead to losing your hard-earned money and inflating these startups' revenues.

To end: Higher Returns also mean Higher Risk!

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals. I have personally invested in a few CSOP deals as well, but those were calculated risks I took based on the overall health of my portfolio.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically, if you are a Tradewithpython subscriber, you know we don't spam.

Lastly, if you like our work, please feel free to sponsor us via Hashnode Sponsors or Buy me a Coffee by clicking here or the button below.

Thank you for reading and hope to see you in the next one!