How Retail Investors Can Navigate Litigation Financing in India

An Alternative Investment Option for Indian Retail Investors.

If you have watched shows such as Suits or Boston Legal, you must have observed the final verdict passed by the jury or the judge at the end of a case. The compensatory damages for even the smallest of matters could go up to millions of dollars. Imagine somehow investing in such cases and receiving a small pie of the total damages if you win the case. Fascinated by the idea? Welcome to the world of litigation financing.

Litigation financing, also known as Third-party Funding, as an investment practice, is quite old and established in countries such as the UK, the US, Australia and other Nordic countries. Recently it has gained traction in India, as the returns seem to be at par with private equity and capital markets. Currently, very few companies deal in Litigation financing in the country, LegalPay being the biggest player (for retail investors) followed by FightRight, Liticap and LegalFund.

How does it work?

In a typical scenario, a claimant (plaintiff) pursues a lawsuit seeking damages from a defendant. The plaintiff approaches a Litigation Financing Company (LFC) and reaches an agreement wherein the LFC would finance their legal costs such as Law firm fees, documentation and filing expenses etc, while the LFC would receive a pre-decided portion of the damages awarded to the plaintiff in case of a win.

Example

Let's say a manpower outsourcing company Brain Ltd. provides service to a major automobile company, say HMC Ltd. Brain raises a bill for Rs. 2.35 Crore for the services they provided to HMC. HMC terminated the agreement after receiving the services and refused to pay the bills.

In this case, to get HMC to clear their dues, Brain will have to go through arbitration, and most likely, appeal to the lower court and then the high court. This would be a tedious process and a costly one too. Brain, being a small company, may not be in a position to burn its resources toward legal costs. Thus they may need to take the help of a litigation financing company, such as LegalPay.

In this situation, Brain will approach LegalPay to fund its litigation expenses. Let's say the Law firm fee is 45 lacs and court and filing fees of 60K. The cost would be spread over the litigation period of let's say 18 months. To fund these expenses LegalPay will have to raise money through investors, either by launching a new fund or accepting more investments in their existing funds. The funds will be managed by LegalPay to pay the above-mentioned costs. Once the case is resolved, Brain may get an award for 2.35Cr along with damages and interest. LegalPay will then receive a portion of the entire award, which it will distribute to its investors.

Let's examine a sample investment opportunity.

As discussed in the previous example, if Brain asks for help from a Litigation finance company, the LFC would have to raise funds from investors. To do so, the LFC would release a new fund offer (shown below). The new fund offer will contain details of the basis of Investment, deployment of funds, service agreement, LLP agreement etc.

The offer will also highlight the target returns, tenure of the fund and minimum investment required.

Above, we can see that the company (LegalPay) is raising funds for small-ticket commercial disputes. The fund will thus focus mainly on small and mid-size B2B litigation with a smaller duration. (More details will be provided in the Investment thesis and target investment area)

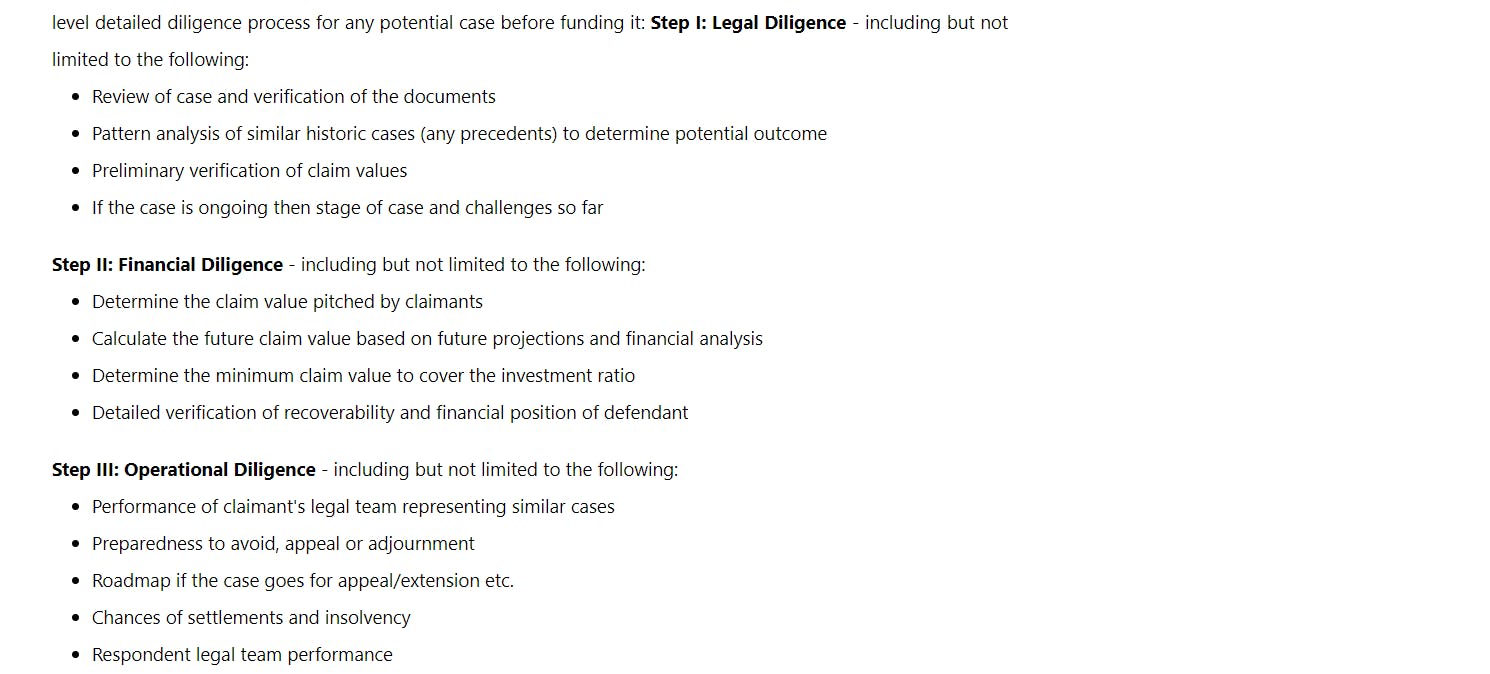

The new fund offer will also disclose the various responsibilities that the LFC (also referred to as underwriters) are supposed to undertake.

As stated earlier, the new fund offer will contain the documents mentioned below. We will get to the LLP agreement in the next part, let's first take a look at the service and risk agreements.

LLP Agreement

Service agreement

Consent & Risk Agreement

I found the following information, which was established in the service agreement, relevant for the retail investors to keep in mind:

Services to be provided by the Litigation Finance Company (LFC)

Management and case diligence fees charged by the LFC.

Success fees to be received by LFC if certain targets (mentioned in the agreement) are achieved by the fund.

Definitions of Important terms such as XIRR, and Hurdle Rate.

Now coming to the Risk agreement, it highlights various risks involved in investing in litigation financing and the consequences of those risks on your investments. We will cover these risks later in this article.

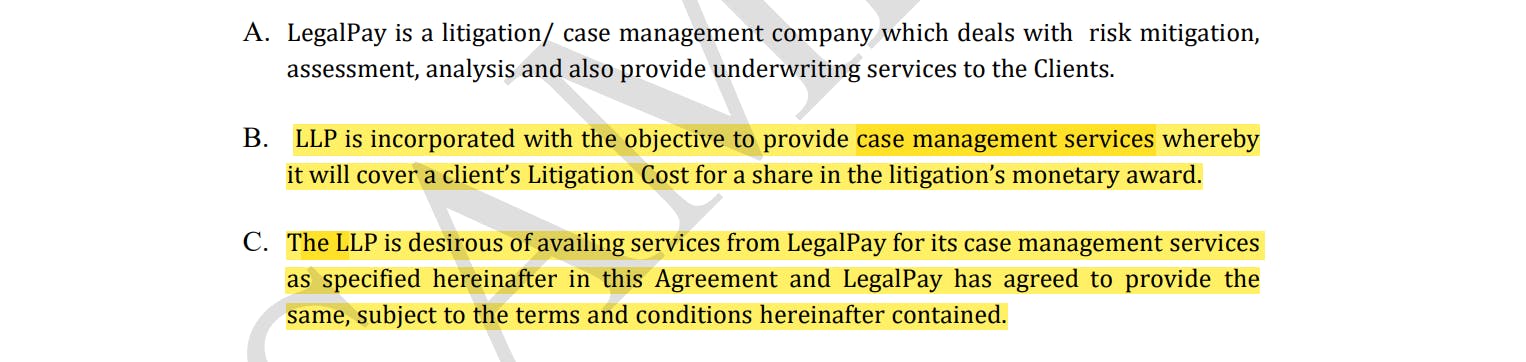

Structure Of Financing

To pool investors' funds, a litigation finance company creates a Special Purpose Vehicle (SPV) in the form of an LLP. The investors are declared as partners in the LLP and get shares in proportion to their investments. The LFC also invests a small portion in the LLP and becomes the Designated Partner in the SPV. The LLP is managed by the LFC, and the equity share capital is utilized over the litigation period to fund the costs.

(Incorporation of LLP - taken from the service agreement of LegalPay's small ticket commercial SPV)

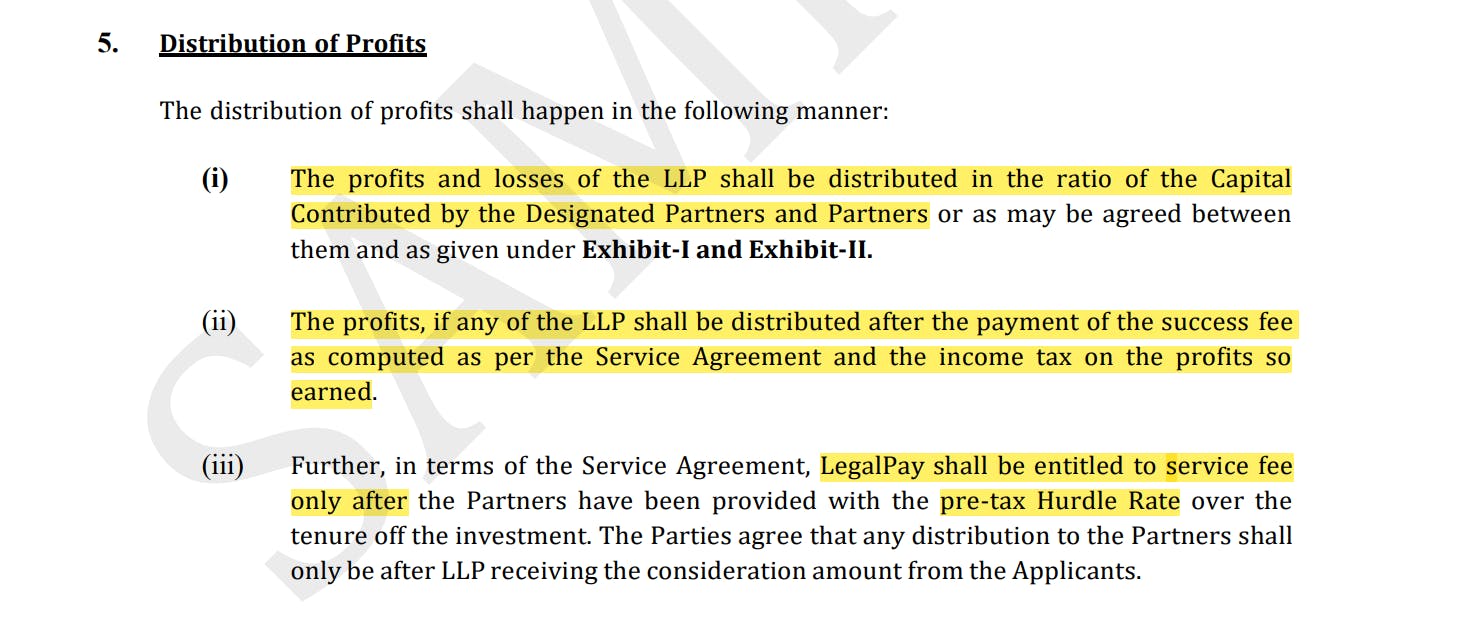

Profits Distribution

Once the case is resolved, the LLP receives its share of the damages or monetary awards which was pre-decided between the LFC and the plaintiffs. The taxes on the earnings are paid on the LLP level, thus the partners (Investors) won't have to pay taxes on their share of profit.

Pros of Litigation Financing

Now let's look at why someone would want to choose this Asset class in place of typical equity and debt instruments.

It gives exposure to an alternate investment option, thus diversifying one's investments.

The ROI and IRR have been quite high in litigation financing. The general market return in this type of financing is around 23-28% IRR.

The returns in litigation finance do not correlate with markets or macro, thus are unaffected during up or down cycles.

No need for personal research into individual cases, the underwriting companies perform all the research and negotiations for you. This can be seen as a risk also.

Cons of Litigation Financing

While reading this article, if you ever thought to yourself, that this looks fairly straightforward and less risky, well you are in for a surprise. Let's look at the risks involved with investing in litigation financing.

- Non-Disclosure Agreements (NDA) signed by the plaintiff/claimant

Pre-investment, investors won't have any idea which cases are being funded by the litigation finance company. This is because the party (plaintiff) receiving the fund signs an NDA with the LFC. Though you will be made aware of the details of the case after the investment as you will be a partner in the LLP.

- Liquidity And Duration Risks

The LFC imposes a lock-in period on the investments, which can range anywhere between 3 to 5 years but can even go beyond a decade (Depending on the type of fund). Even though LFC will give you a rough idea about the timeline of cases, more often than not, it is unpredictable.

- Withdrawing investment before the lock-in period

You can get an exit before the lock-in period, in case there is a secondary sale by LFC or if other partners of the LLP agree to a buyout. But in that case, your stake would be bought on the original valuation, regardless of the accumulated profits in the LLP.

- Lack of Legal framework

There exists no legal framework to regulate litigation financing in India. Also, unlike other Western countries, litigation finance companies are not registered as AIF, AMC, Investment advisors or PMC. You will be a partner in LLP and any disputes with the designated partner will be resolved as per the rules set by the Registrar of Companies.

- Other risks investors will be exposed to

Should You Invest?

Litigation financing is a unique way of diversifying your portfolio, getting exposure to an asset class that in most cases is unaffected by the markets. This route of investment promises very high returns but (obviously) comes with higher risk. Duration risks, frauds, disputes, and liquidity are some of the risks that one should keep in mind.

It's up to you to decide whether the prospect of high returns and unique asset class outweighs the risks involved with this investment opportunity.

Finally, My views on the industry

This is my own opinion, and a retail investor is welcome to skip it however I want to speculate what would be the future of this industry in India. Currently, as we know, the LFC is not part of any regulatory framework and is not registered as any investment-related entity, I expect that there will be a regulatory framework in the future (although not sure which regulatory body would look after this)

My guess is either SEBI might oversee it, and such entities could be declared as CIS (Collective Investment Schemes), with some interference from the Bar Council of India (BCI) or the BCI will be the first to grab the opportunity to create an entirely separate regulation for it. I believe it depends on the companies operating in the space, and the amount of interference and involvement they have in the actual legal proceedings going on in courts.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.

Lastly, if you like our work, please feel free to sponsor us via Hashnode Sponsors.