P2P stands for Peer-To-Peer Lending and this type of lending has been going on for decades in an unregulated offline manner. Some fintech companies saw this as an opportunity and attempted to organize the market in an online manner so for example, if any borrower needed funds in Jaipur, another investor sitting in Mumbai could fund their loan. This concept blew up, and RBI took notice and brought the NBFC-P2P license into the market in 2017 through a Master Direction.

Today's company for this article Monexo started in 2016 even before RBI brought the regulation into the picture. It is one of those P2P companies that is not too big in size but has operated well within the lines defined by the NBFC-P2P regulation (more on that later)

To write this article, we had a first-hand call with Mukesh Bubna (Founder: Monexo) who walked us through their model, platform and thoughts on the overall P2P industry which we have covered here in a podcast as well.

Corporate Structure & Founders

Monexo (Monexo Fintech Private Limited) was incorporated in January 2016, so it has been in the P2P lending business for almost 8 years now. It was one of the first 5 companies to get the NBFC-P2P license in July 2018.

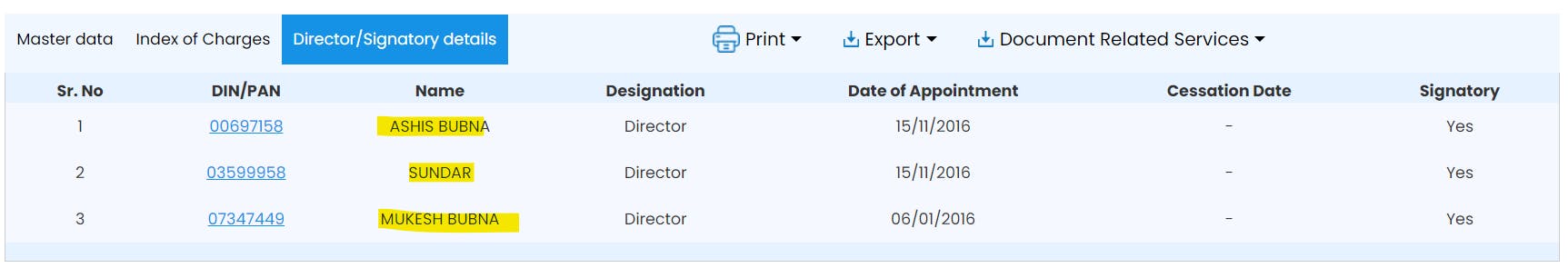

As per the latest MCA Filings on 28th Nov 2023, there are 3 directors of the company:

Mukesh Bubna is the Founder and CEO.

Sundar M is the COO and looks after the Operations, Accounts, and Legal.

Ashis Bubna is CBO looking after Business and Partnerships.

Talking specifically about Mukesh, he is an accomplished finance professional with almost 2 decades of experience. He has held some very prestigious positions in big corporates. His last position was Director - Asia Pacific at Western Union and before that, he was the Director - Product & Marketing - Cards at Citibank. He originally started Monexo in Hong Kong but retreated in about 2.5 years due to unclear regulations and entered India.

Would also like to highlight that IDFC First Bank is a minority shareholder in Monexo.

Business Model

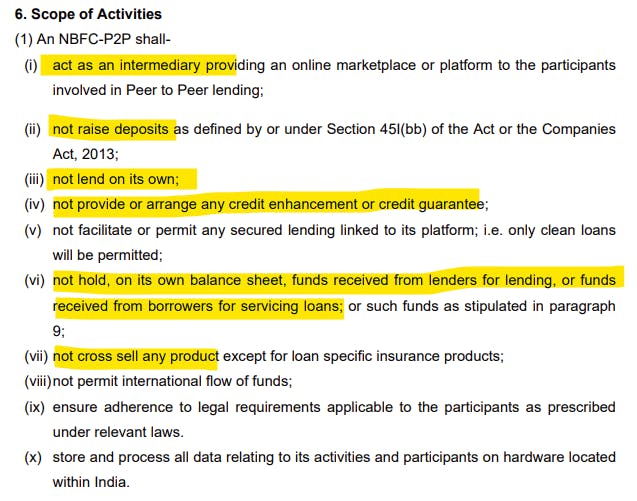

To understand the business model of any P2P platform, you have to understand the NBFC P2P regulations first which are given by RBI. Below is a screenshot of what is the scope of activities for a P2P platform. I have highlighted the important bits below.

The guidelines are pretty much clear, the P2P platform will only act as an intermediary/passthrough between the lender and the borrower and cannot do anything beyond that.

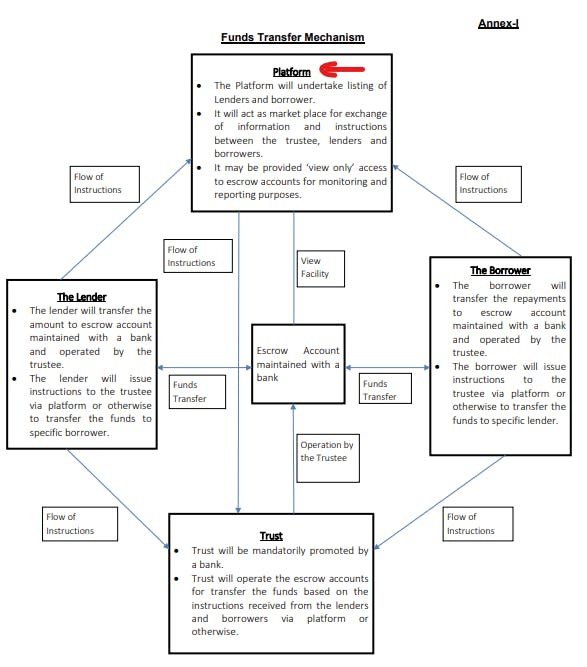

That means Monexo will find borrowers who are interested in getting loans and investors who want to give out loans and just connect them, they cannot offer any guarantee, security, credit enhancement or anything else that is beyond the above guideline. The below chart from RBI Master Guidelines also clearly shows how the money flows in the overall P2P ecosystem when you interact with the platform.

So, to summarize from a business model point of view, Monexo is there to earn a fee for the services provided to the borrower to get a loan and for investors to get repayment of their invested loans.

How does Monexo source borrowers?

So given there is a crystal clear defined framework for all P2P platforms, the question then becomes what is the quality of borrowers coming onto the platform and what is the overall default rate for the loans on the platform?

Monexo has two different approaches to sourcing the loans:

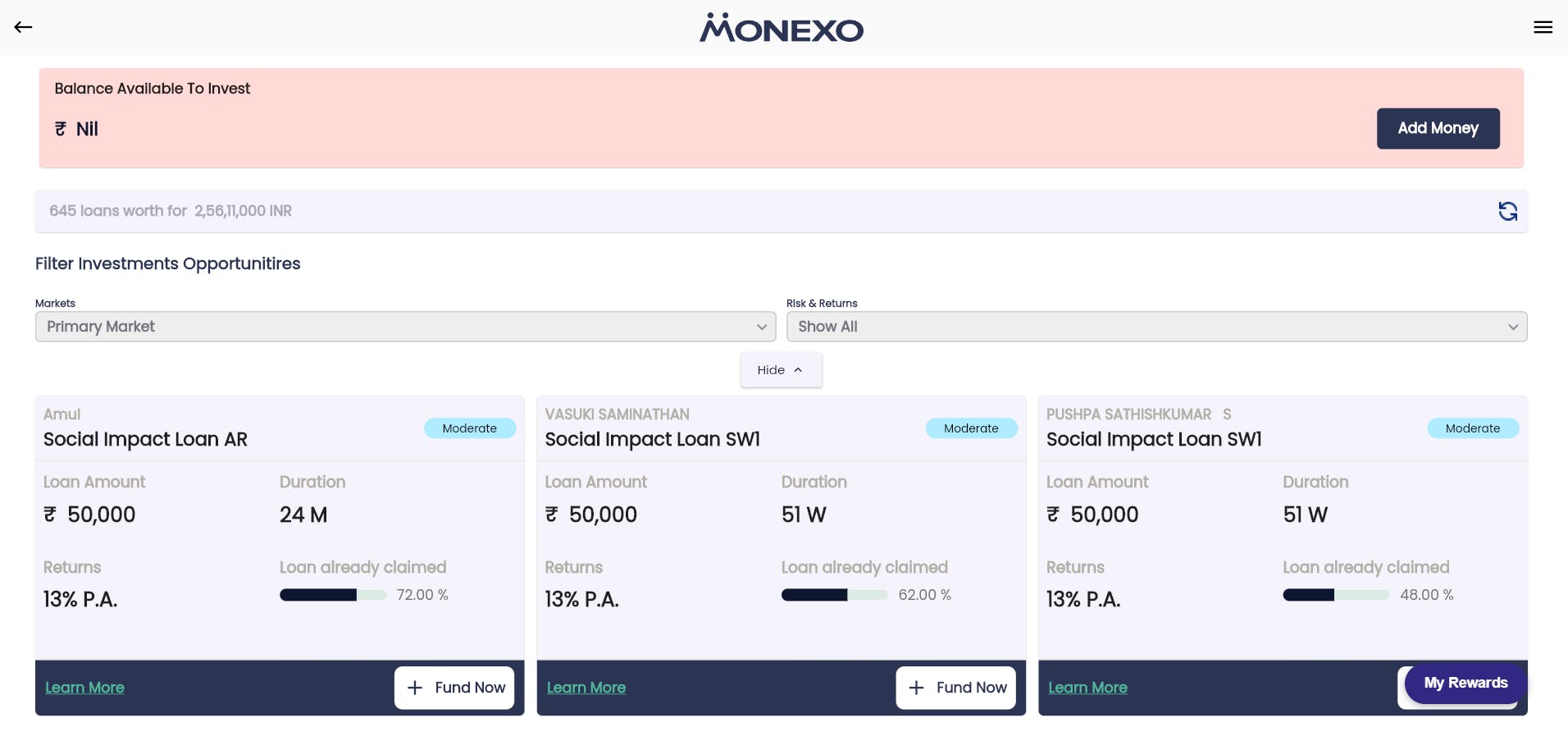

- Social Impact Loans (SIL) / Micro Finance Loans (MFI) offering up to 13% interest to the investor is done with a branch presence in rural areas and are only given to entrepreneurial rural women who are not very tech-savvy. The branch field agents use digital tools to capture, verify and get decisions based on the rules maintained in the system. Monexo assigns a "MODERATE" to "CONSERVATIVE" rating to these loans.

- Small Ticket Personal Loan (STPL) is done via an app called ZapMoney which is completely owned by Monexo Fintech Private Limited. The borrowers here are generally "New To Credit" category or customers who need a short term loan and Monexo offers up to 20% interest on these loans but also assigns them as "HIGH" risk.

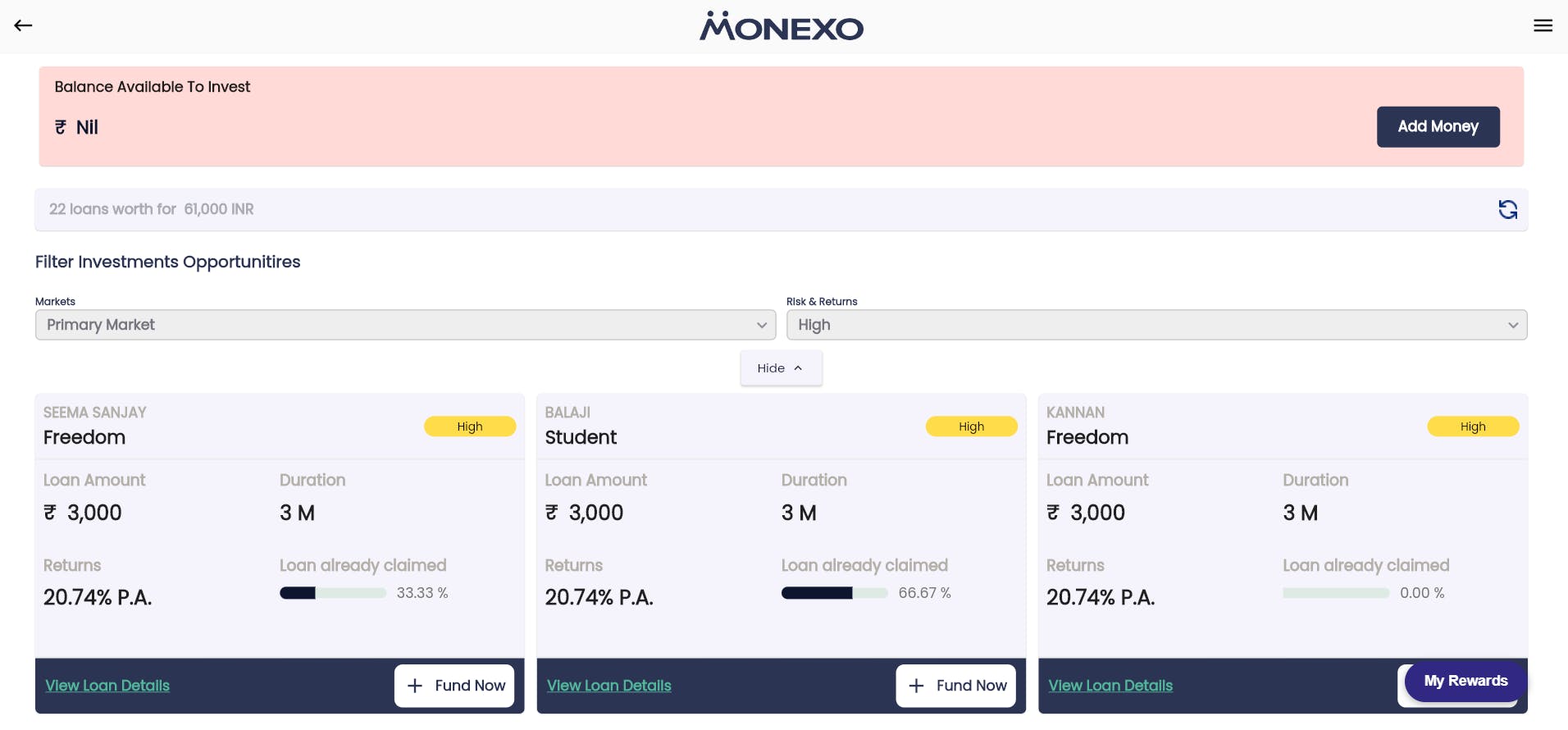

How does the investment work?

Monexo doesn't have any fixed maturity, fixed interest plans like most of the P2P lenders do which is a very good thing in our opinion as these fixed plans are currently in a gray area and RBI has been actively investigating some wrongdoing on certain platforms. Moreover, offering fixed products can also lead to ALM (Asset Liability Mismatch) issues, about which we have written in this article. Highly recommended to read.

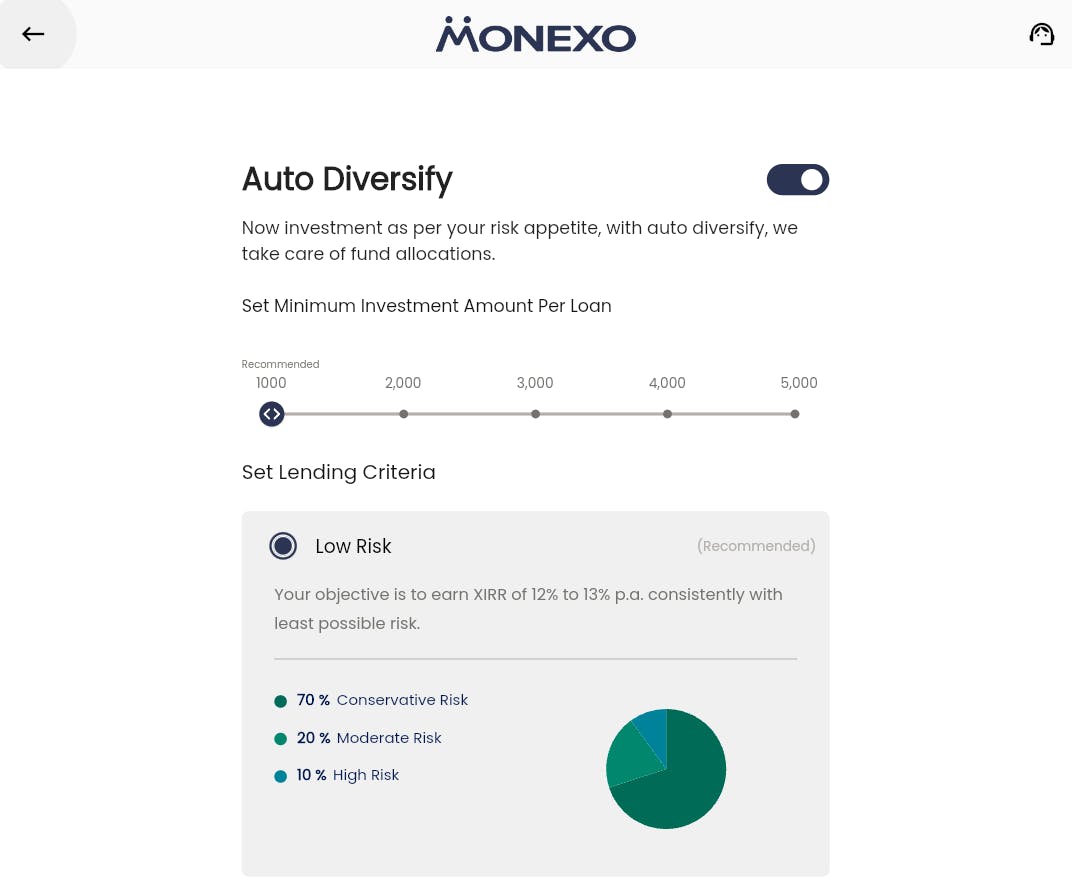

To make your investment, you need to choose the loans, and risk profile you would like to invest in and you have to stick to the tenure of the loan which you fund. Your monthly interest and principal repayments can be reinvested into fresh loans, for which Monexo has an auto-diversify feature where you can set the maximum amount you would like to allocate to a loan (Max is ₹5,000 so you get diversification benefits) and the risk category you want exposure to.

What if defaults happen?

It is just natural for any lending business to have some form of Non-Performing Assets, regardless of any superior technology Monexo puts up for credit risk assessment, people can still choose not to pay loans. In those cases, especially for the high-risk loans, Mukesh claims that Monexo will not stop recovering the defaulted loan. Legal processes are slow in India but they will pursue collections till they can get arrest warrants and recover. They will abandon collection only for death cases. They will also report the default to the credit rating agencies like CIBIL and Experian and it will become difficult for the borrower to borrow more money until they repay the amount.

Post the podcast (mentioned above), someone in our Whatsapp Community asked for proof that his invested defaulted loans (2+ Years Old) were still being pursued and Mukesh kindly shared the evidence which has added to my confidence as well.

For the Social Impact Loans category, the recovery process is a bit different which Mukesh has highlighted in this video.

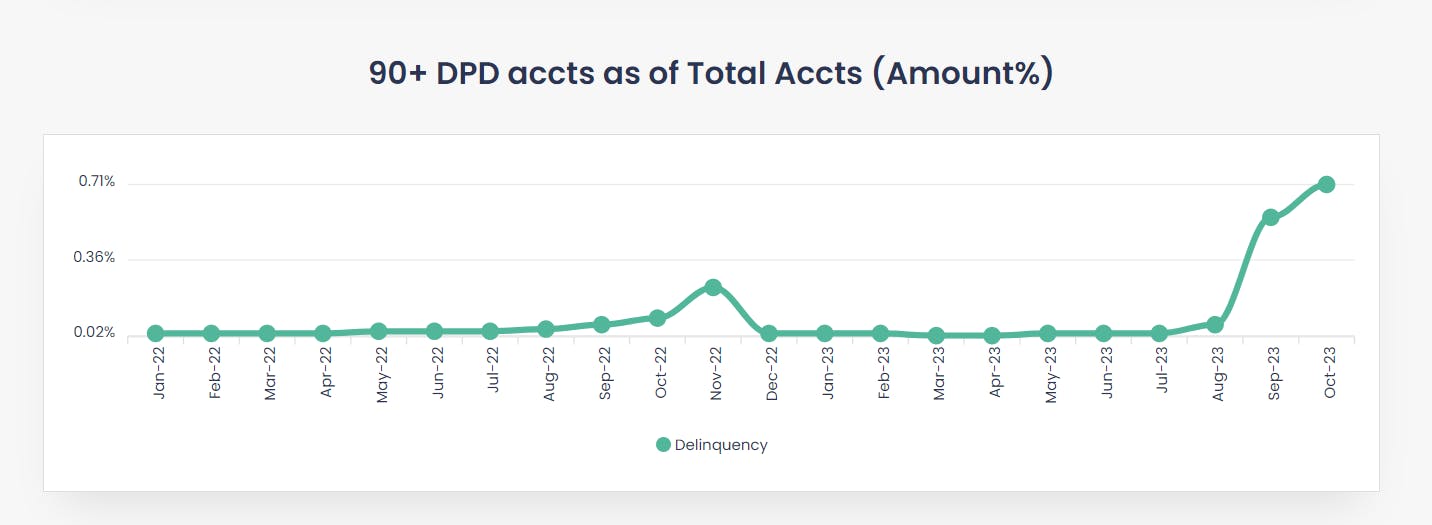

Monexo also highlights how much % of their overall AUM right now is delinquent/default for more than 90 days. All info is available on the Portfolio Page.

All costs of recovery of the loans are taken on by Monexo and if Monexo is able to recover the amount from the borrower, all interest on the outstanding balance till the investor pays at the rate of XIRR is passed onto the investor.

Monexo charges a small penal interest over and above the XIRR to the borrower, but this is not given to the investor but used for collections and legal expenses.

Things we like about Monexo

We will not talk about the pros and cons of P2P Lending since we have already covered it in this article.

For starters, I would like to appreciate the Monexo Founding Team by not launching products that are into a grey area (fixed maturity, fixed return products), it is very easy to get lured into doing the same thing to grow at a similar pace as the industry but Monexo team has stayed away from it and I consider that to be very credible/ethical.

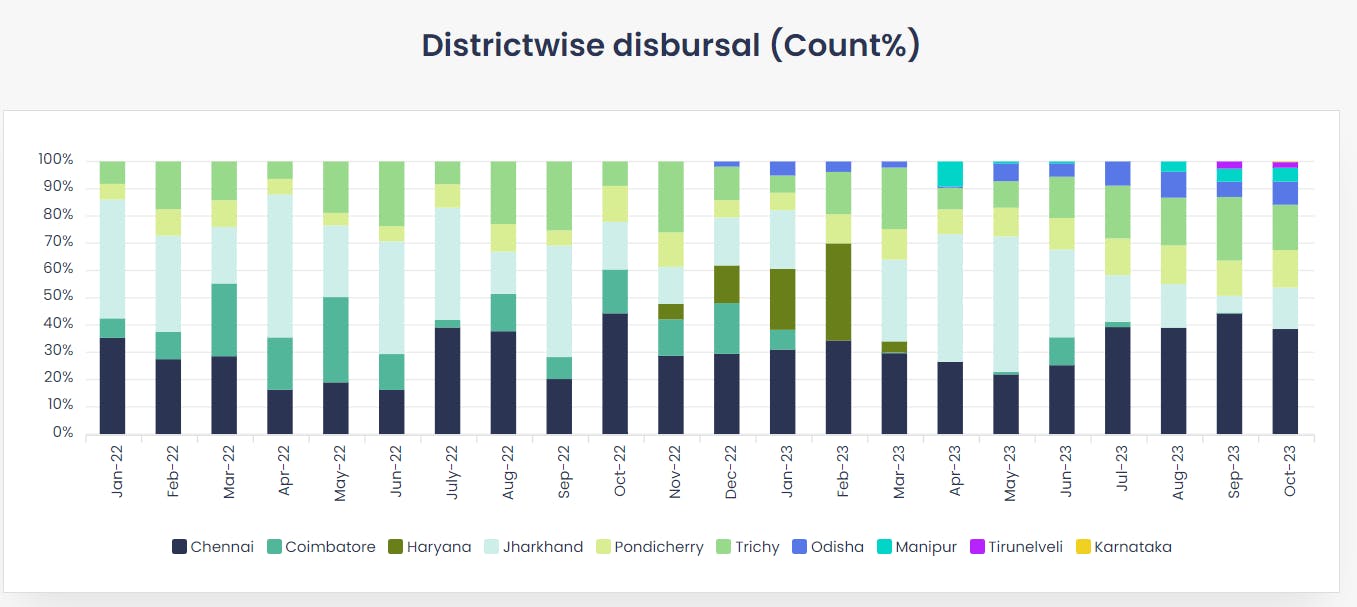

They are much more transparent in terms of their portfolio as compared to other peers, on this Portfolio Page they also publish which district they are giving loans to, what's the ticket size, what is the frequency of repayment, etc. All of this info is not mandated by RBI but they choose to give it in so investors can make informed decisions. See the sample chart below:

You have the option to invest in different loans based on the risk profiles. Risk profiling also helps a lot to the investor to make a decision.

All three CXOs are financial industry veterans and bring a lot of experience to the table.

Things we don't like about Monexo

The alternative investment space in India has now picked up quite a lot since Monexo started and some products can genuinely offer better risk-adjusted returns than what Monexo offers in the Moderate/Conservative risk category, hence the offering might not look that attractive anymore.

If you are investing on the web version of the platform, the experience is not very smooth and you might struggle to invest your funds or evaluate borrower profiles.

For the Social Impact Loans, as a prudent investor, I would like to know the CIBIL score of the borrower (which is not available at bureau as per Mukesh) and see if they have any existing loans and other data that are present on the High-risk loans, Monexo doesn't show all this data at this stage but speaking to Mukesh, I understand it is in the pipeline to be released.

I had also appreciate some bifurcation of default % on different risk category of loans. Like I would be very interested to know how many High Risk loans have defaulted as compared to Conservative Risk, this will help in better decision making.

Bottom Line

P2P Lending is definitely a better alternative product as compared to other unregulated products since there is a very clearly defined RBI Framework and on top of that, it is my opinion that Monexo operates it very ethically. Mukesh was very transparent during our podcast and has personally helped me and the community understand this product better.

Quick call out that as of writing this article, I have invested a nominal sum of ₹20,000 in different loans (High, Conservative, Moderate) on Monexo and my experience has been good so far apart from the UI side of things. Now whether it makes sense for you to get into P2P is completely based on your risk profile and the other options available for you from an investment point of view.

But hopefully, this knowledge fact-based article on Monexo will help you with decision-making across different P2P platforms and if you like this article and decide to invest in Monexo, please consider using my referral link here (Referral Code: CJPA874), if you invest a minimum of ₹20,000 I get a ₹1,000 as referral rewards and you get ₹2,000. This small amount helps us run this blog.

If you have any more questions based on this blog or the podcast we have done with Monexo, feel free to comment on this blog or YT video or join our exclusive Whatsapp Community where you can ask the question to Mukesh directly by using the link below.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.