OBPP stands for Online Bond Platform Providers and Aspero along with its related company Yubi is probably the largest player in this space. They have sold about ₹25,000 Crores INR worth of bonds so far.

Aspero was recently branched out of the overall Yubi group and rebranded to comply with the OBPP license which requires the company to sell only listed, rated, regulated products whereas the wider group Yubi can do private, unlisted issues as well.

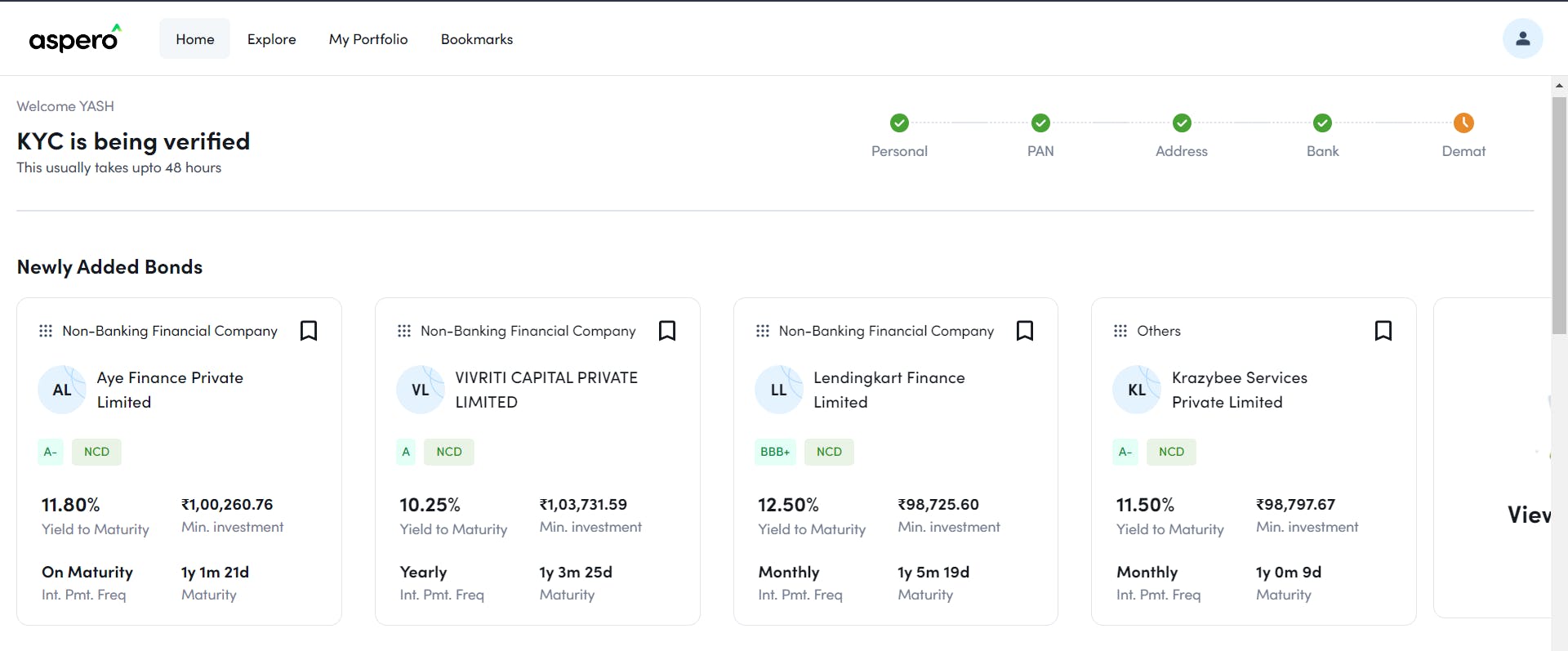

Aspero aims to serve primarily the retail segment of investors by offering fixed income products like Government Securities, Corporate Issues, SGBs, etc etc starting from as low as ₹1,000.

Lets delve deeper into Aspero as an alternative investment platform. To write this piece, we understood the business from Vibhor Mittal (COO at Aspero) and also recorded this session. If you prefer listening to the podcast in detail, here it is:

Corporate Structure & Founders

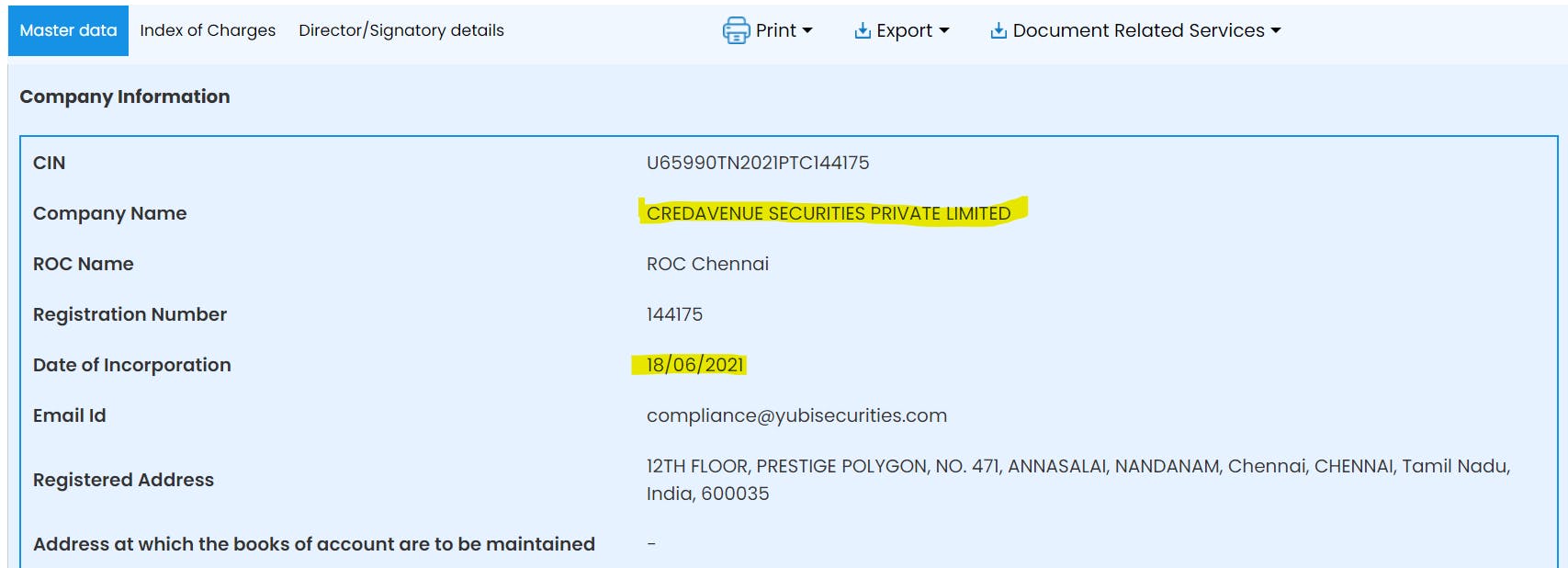

Aspero is a registered Trade Mark of Credavenue Securities Private Limited and as per MCA records was incorporated in June 2021. As we mentioned above Aspero was a rebranding of Yubi Invest because of the OBPP rules.

One more thing that caught my eye was the massive ₹422 Crore Authorized & Paid up capital. These figures suggest this is a huge company. So for some context:

Authorized Capital: the maximum amount of shares that a company is authorized to issue.

Paid Up Capital: The amount of money that has been received by the company from shareholders in exchange for shares.

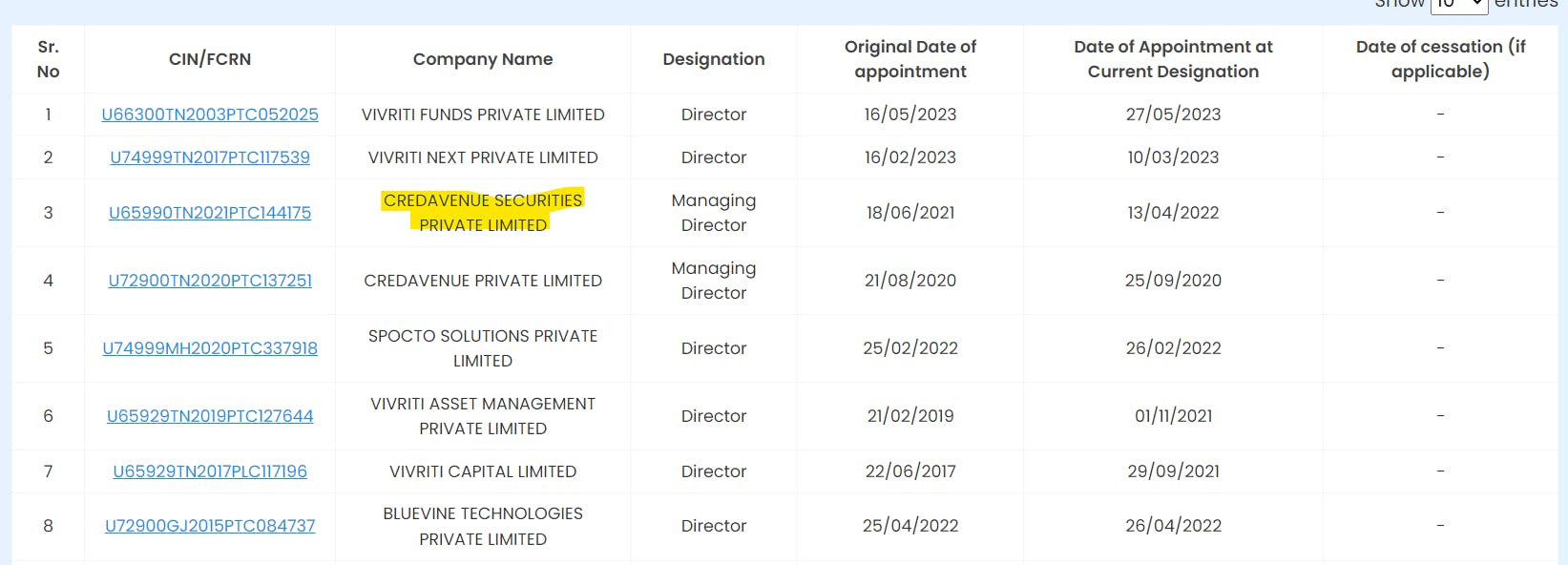

As per latest MCA Filings, below are the directors of the company, their Linkedin profile is hyperlinked:

Vineet Sukumar (Founder & MD at Vivriti Capital as well)

Gaurav Kumar (Managing Director)

Anup Wadhawan (As per Linkedin, He is Independent Director)

Talking about Gaurav Kumar, who is the face of the company, he is involved in various businesses in the financial services domain and has built Yubi from the ground up into a powerhouse of lending tech products.

Below screenshot shows Yubi's suite of lending tech products. All business for Yubi happens in Credavenue Private Limited which is different entity to Credavenue SECURITIES Private Limited which houses Aspero.

Aspero's Business Model

Talking about their business model, to be honest its not that complicated to understand, like any other alternative investment platform, they work with multiple stakeholders in the ecosystem like NBFCs, Startups, Established businesses, etc who are in need of additional capital in the form of debt in any form possible. Given their expertise and relationships via Yubi, Aspero is able to source the best deals at an attractive pricing which are then made live on their app to be sold to retail investors. There are three main areas where they earn money:

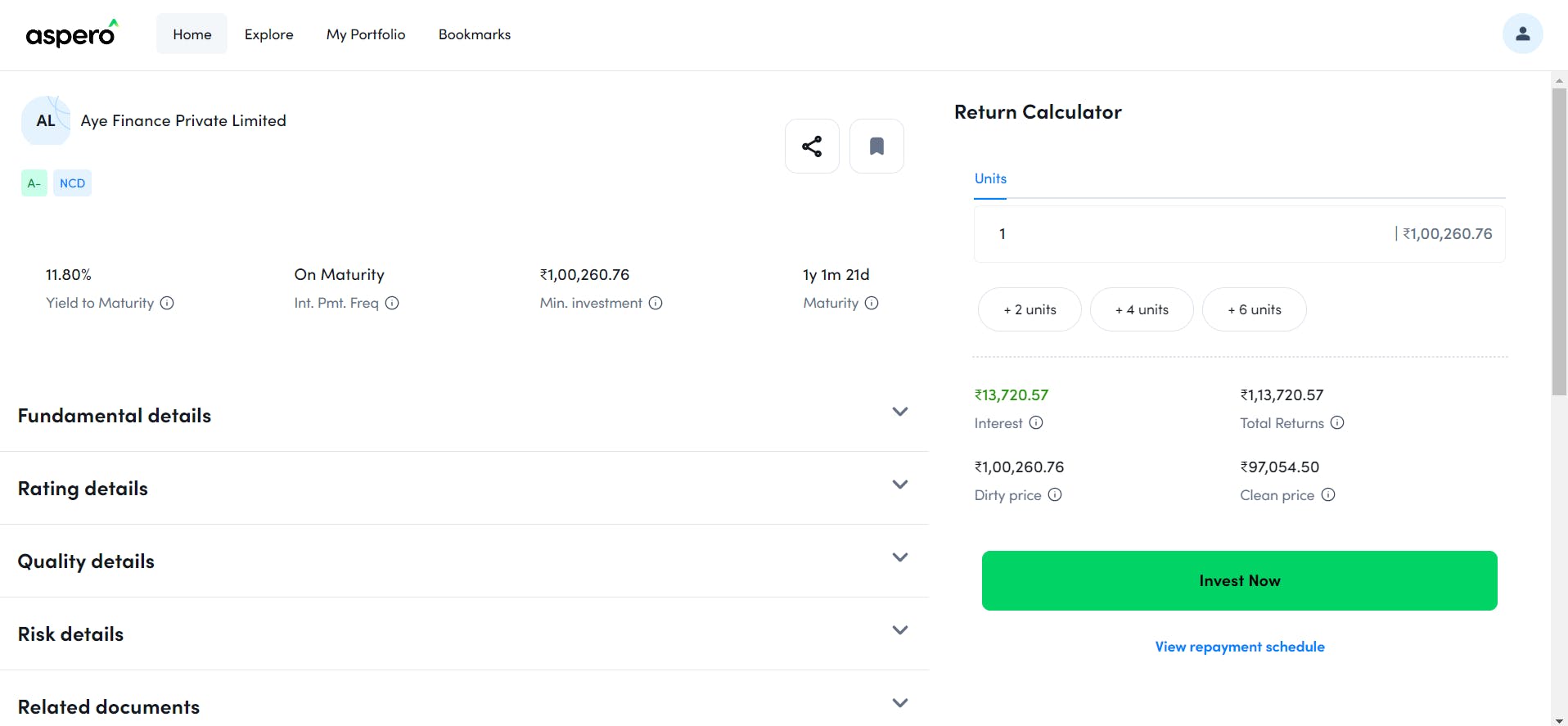

- Sourcing attractive corporate debt issues with different risk-reward ratios from existing NBFCs/Lead Managers in the ecosystem. For example taking Aye Finance Private Limited in below screenshot, Aspero might have sourced it from issuer in a big tranche of 100-150 Crores maybe at 13% and then selling it to retail investors like you and me at 11.80% for min. ticket size of 1L earning a 1.2% spread.

Structuring its own products like SDIs (Securitized Debt Instruments) which is not happening at this stage but as per our podcast with Vibhor, they are planning to do this very soon and will have better margins to play around with. Other industry players like Grip Invest, Wint Wealth, WiseX are also actively moving in this direction.

They will also earn money by facilitating the trading of bonds in the secondary market. As per Vibhor, there are active plans to launch this feature where the investor can be quoted a bid-ask spread to buy/sell bond to Aspero or another investor on Aspero. Think of it just like an exchange. Aspero will pocket some charges in facilitating such trades and enable liquidity for investors.

Aspero being a regulated OBPP entity is restricted in terms of what it can and cannot do. We have outlined all key do's and don't about these platforms in the below article which we highly recommend you to read:

Aspero & its related entity has sold bonds worth over ₹25,000 crore via its retail platform and wealth manager platform so they are huge and capable of doing very large transactions as well and as per Vibhor they are connected to 5000 different players in the ecosystem which is not that surprising given their scale of operations.

How to Invest?

Aspero is also directly integrated with the stock exchange to facilitate transactions on its platform and settle the bond in the investors demat account on T+1 basis.

All you need to do is Sign up, explore the listing and complete a mandatory KYC process to invest in the product. On Aspero, you can invest beyond market hours as well.

They also have a mobile app which in my opinion is better than the desktop version.

Can Defaults Happen?

Debt instruments in nature are less riskier than equity investments, but it highly depends on which kind of bond you have purchased. Now with so many options available in the market like NCD, MLD, Unlisted Corporate, Govt Bond, it can get very confusing on which option works best for you. But one thing which is always very helpful to know is the rating of the bond.

Source: Wall Street Prep

The higher the rating of the bond, the lower the credit risk. So in above table, if a Bond X is rated AA and Bond Y is rated BB, Bond X will be much more safer than Bond Y but will also yield less returns when compared. The beauty of debt market is there is something always available suiting the investors risk profile.

Things we like about Aspero

The very first thing is they are regulated under the SEBI OBPP framework which has very clear defined rules, regulations and dispute resolution frameworks. So no dealing with ambiguous investment vehicles and structures.

They are biggest players in this game and have been there for the longest time period as well. They have well defined procedures for each and every thing. Aspero is a new launch but the foundations of the core Yubi business is very strong.

They have multiple opportunities live at any given time with different time horizons and different risk-reward ratios.

They are actively building on allowing investors to sell their bonds in the secondary market, either to them or to another investors via their platform which will increase liquidity.

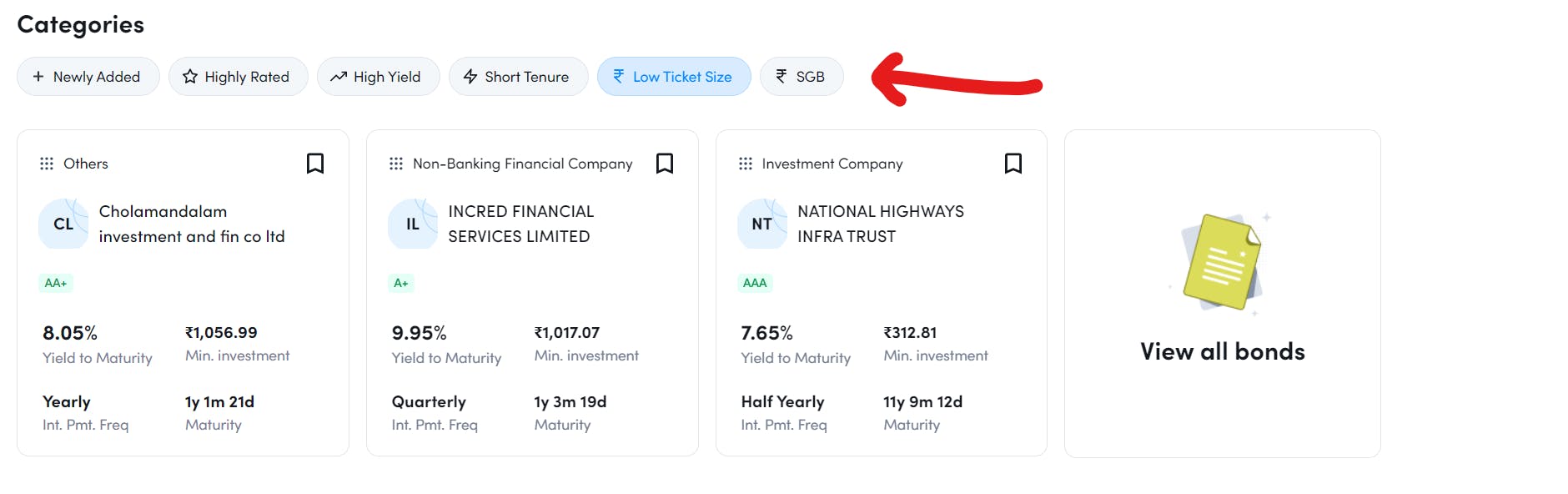

Aspero platform is intuitive and bonds are even divided into categories which makes it easier to navigate for investors based on their preferences. The lowest amount you could buy a bond is also around ₹312 which is quite low.

Things we don't like about Aspero

Their High Yield opportunities were a bit on the lower side in my opinion, giving only about 13% returns. This might not be enough for some aggressive investors.

All opportunities are shown in IRR (Internal Rate of Return) which can be misleading for bonds as it assumes all interest payment received is reinvested at the same interest rate, which is not always true as TDS payments are also deducted and clearly can't be reinvested at same rate. To be fair this is an industry wide problem and not specific to Aspero.

For a normal retail investor, ratings are a good metric to check, however what would be helpful for Aspero is to show the average default rating for that rating across the overall Indian debt markets. This figure is published by rating agencies regularly and would give a fair idea to the investor on history of defaults for that rating.

Their web version of the platform feels very buggy and would need improvements, their mobile app works fine though.

Bottom Line

Our regular readers might realize that this article is very similar to our Company Profile article on Grip Invest, that's because both the platforms are run exactly as per the same rules by SEBI and are good platforms. But Aspero has a greater advantage when it comes to dealing with issuers like NBFC, Private Companies, etc due to the quantum of volume they can move via their retail and wealth channels and also have the ability to source better deals for investors as well.

Once they enter into structured products, it will be very healthy competition for the industry and win win for investors. I am also particularly excited about the secondary market piece which Vibhor and team are building. Do checkout our podcast if you haven't seen it already.

For anyone new entering into debt markets or alternative investments market, I would recommend you to checkout Yubi's offerings as they have something for everyone.

We hope this piece was helpful, we will see you in the next one. If you have any questions on this piece, please mention in comments below or join our WhatsApp Community to ask your questions directly where we will promptly answer them. You can join the community below.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.