Welcome back to the much awaited 2nd article in the Red Flag Series on ALT Investor, in this article, we will coverWO Trades, another famous platform particularly in the invoice discounting space which is a very popular product amongst our community members. As of writing this article, WO Trades offers the following products for investments:

Invoice Discounting

Angel Investments

Fractional Real Estate

In all their deals irrespective of the product, they are offering atleast 17-18% returns, sometimes even upto 24% in the Invoice Discounting space, the key question is what are they able to do differently to bring issuers who are ready to borrow at that higher IRR. In my opinion they might not even be legit, let's find out why?

Also to clarify, the idea of this series is to make you think of key things to check before making your investment, ALT Investor or its representatives are not registered with any regulator to offer you any form of official advice.

Because we couldn't get a chance to run our findings by them, we have written this article independently based on pure facts and we have no intention to damage WO Trades reputation, but have full intent to educate and safeguard our fellow investors in the alternatives space.

List of Red Flags

We will not follow the usual Company Profile structure, but instead write about the Red Flags of this platform due to which investors should think twice/thrice before investing their hard earned money.

#1 No Public Info on Directors/Owners of the Company

WO Trade Ventures Private Limited (CIN: U72900TG2023PTC170067) is the legal entity behind WO Trades (https://wotrades.com/) platform. It was incorporated on 5th January 2023. As per MCA the directors of the company are Manoj Challa and Anil Reddy Kondapu Reddy.

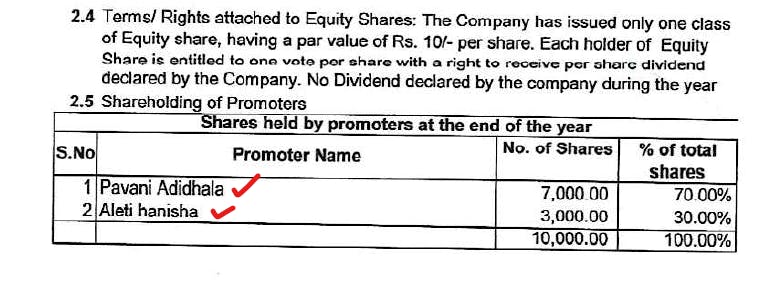

The current directors were appointed on 1st August 2023, around 7 months after the company started, a paid download of documents from MCA suggests the previous directors were:

Pavani Adhidhala and Aleti Hanisha are actually the ones who own the company. Again, there is almost no information on who these individuals are, but keep the Adidhala family name in your mind for now, it will come up a lot in the course of this article.

Checking on Linkedin, I couldn't find any individual associated in the risk and compliance functions of the company as well, a thumb rule check I suggest everyone to do, because how are they even assessing the credit risk in a deal and bringing it on the platform if they don't have the right set of people with them?

#2 Poor KYC Checks

To register on the platform, I had to provide my PAN Card, Aadhar, Address and my bank account details. While uploading Aadhar, I did not upload the correct file, it had none of my Aadhar details and the KYC was still approved instantly suggesting it's just a fake sense of comfort given to investor to make them look genuine, no one is actually checking all these docs as long as investment comes in.

#3 Related Party Deals on the Platform

At the time of writing this article, there were two deals listed on the platform, let's talk about them one by one:

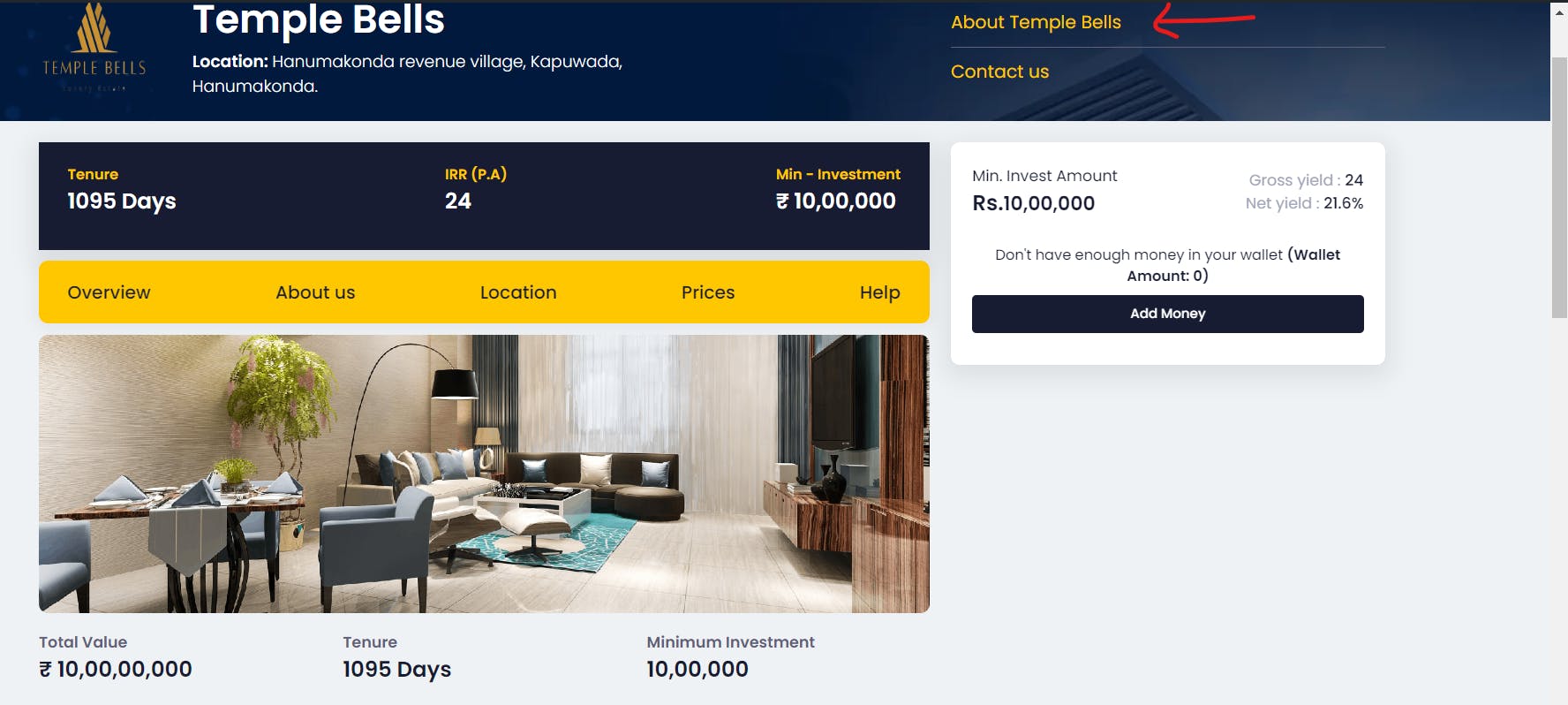

Fractional Real Estate Deal on Temple Bells

This deal claims to offer a Gross Yield of 24% and a Net Yield of 21.6% for a Tenure of 1095 days and the minimum investment is 10L rupees.

There is no mention whatsoever on what is the structure of this deal, is it ownership in some LLP, is it some Non Convertible Debenture, is it something else, not sure.

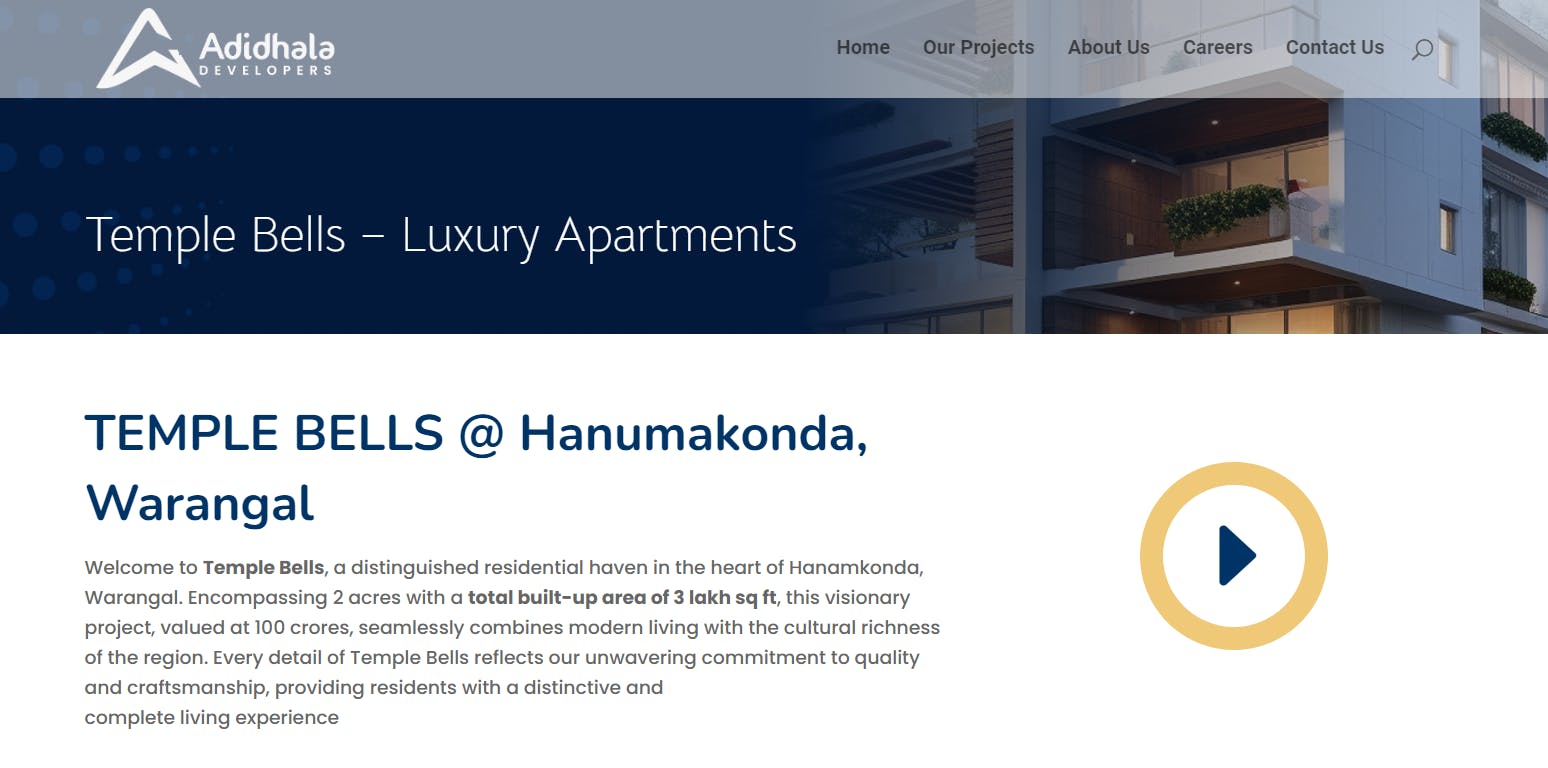

When I click on "About Temple Bells" highlighted by red arrow above, you get to this page and surprise surprise, do you see who is developing this property? Does the name "Adidhala Developers" ring any bells?

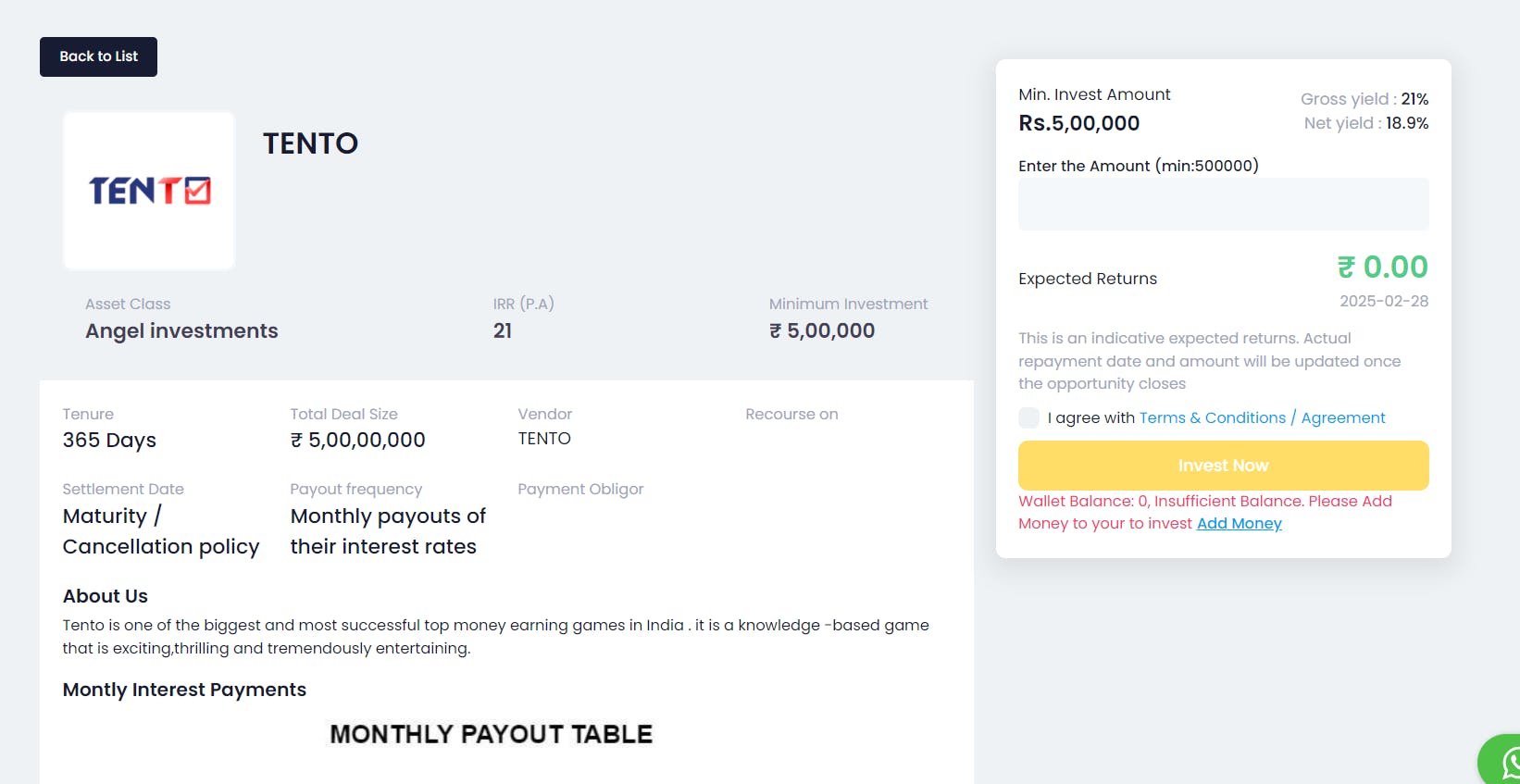

Angel Investment deal on Tento

Another deal in the angel investment category promises to pay Gross Yield of 21% IRR and Net Yield of 18.9% IRR with a minimum investment of 5L Rupees for a tenure of 365 days.

Again there is no information on how is this deal structured, is it a loan to the company, is it equity investment, they call it angel investment on the platform but no equity ownership is given as there is a defined tenure. Even the Angel Investment Agreement given by them (access it here) is complete bogus and won't stand anywhere in court.

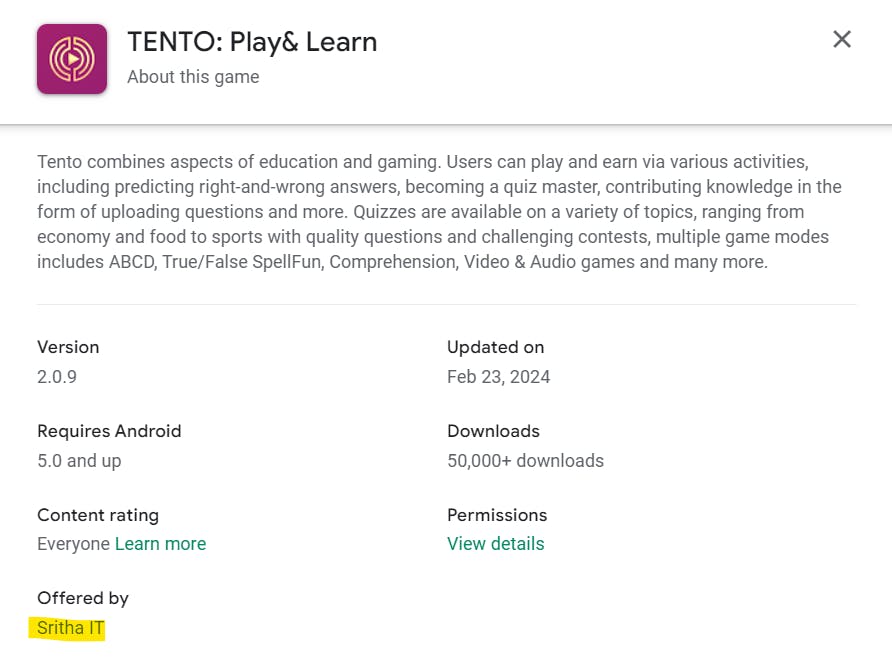

A quick search on them on Play store tells me that the app is by a company called Sritha IT.

Who is the director for Sritha IT Services Private Limited?

Does the highlighted name ring any bells, the Adidhala Family again.

Via both these deals, it is clear that these two companies are by the same family who actually owns the WO Trades platform as well and nowhere they have mentioned it to be related party transaction. Do you expect them to do due diligence on their own companies and provide you with the best deal?

#4 Agreement is legally invalid

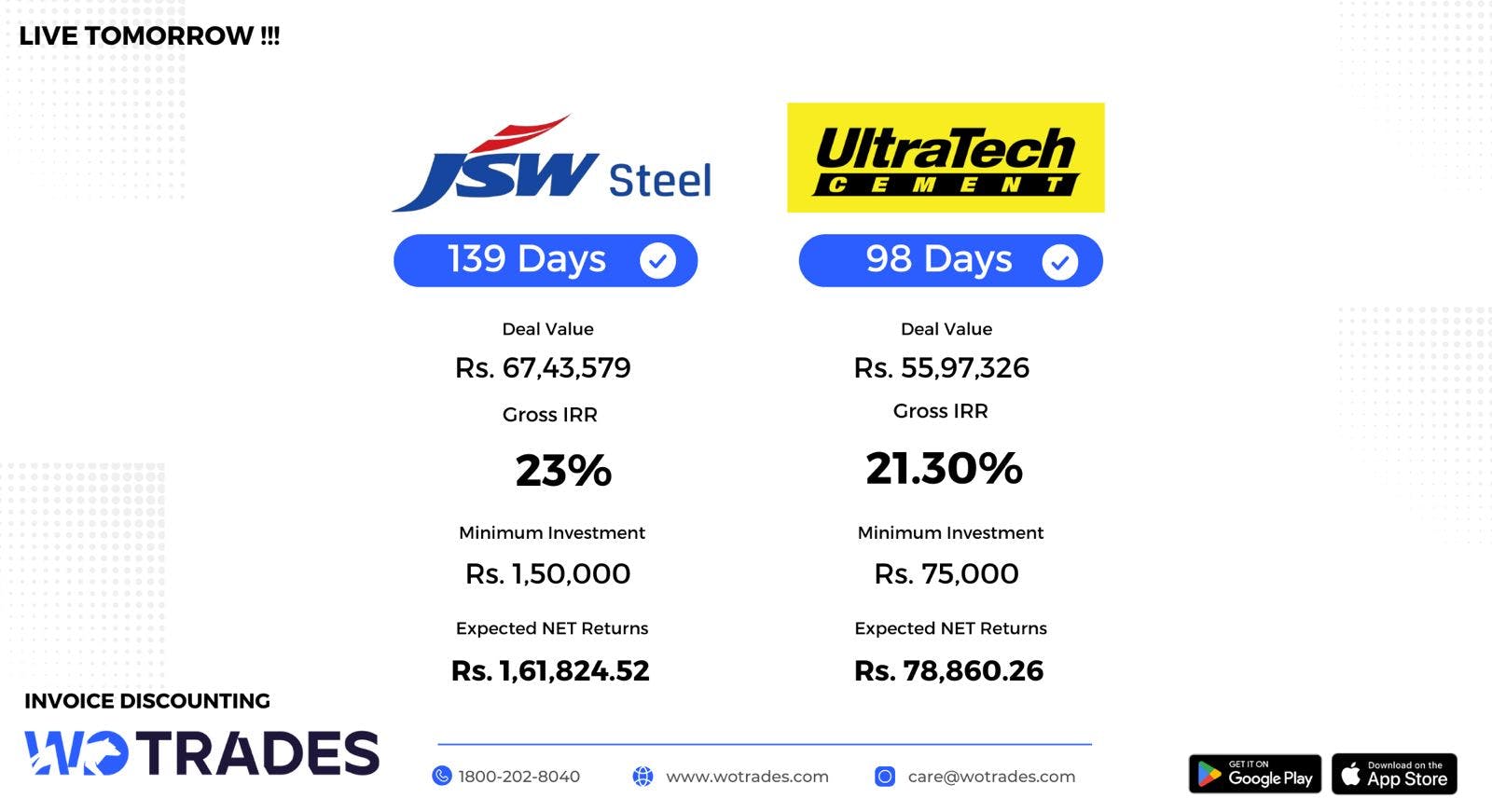

While at the time of writing this article, I couldn't find any live invoice discounting deal, I checked for 3 days in a row and there was no deal, but one of our community members kindly provided with a copy of the agreement, which can be accessed here. I was also advertised some deals by their relationship manager on Whatsapp but I couldn't see them online, the deals have some unusually high IRRs against blue chip companies which is well above the industry benchmark and questionable. One deal that the relationship manager sent me was this, he was not able to share the copy of actual invoices when asked.

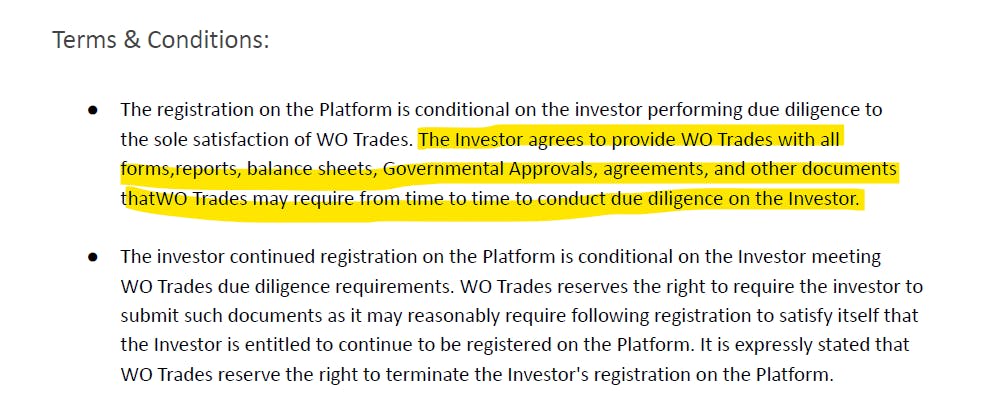

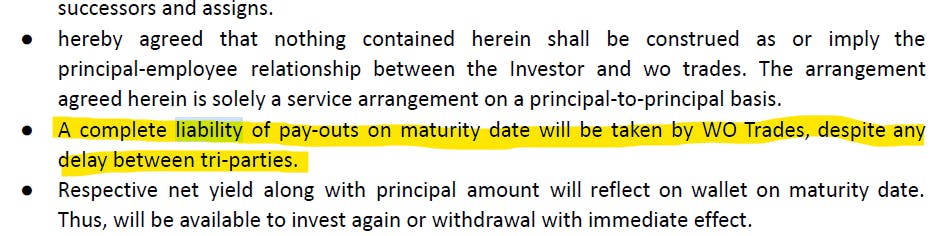

I deleted the last page from the agreement which contained the personal details of the community member but if you give it a quick read, you will realize there are lots of inconsistencies, poor wording, like look at below highlighted example:

They want to do due diligence on Investor instead of the company, why does the investor have to provide you which balance sheets, govt approvals, etc. It doesn't make sense at all.

Also the agreement has the below point mentioned in it, which acts like a guaranteed return on invoice discounting deal, there is no mention whatsoever on how WO Trades plan to achieve it.

In my opinion, this is just to give a fake sense of comfort to the investor for them to invest, moreover the agreement is not on stamp paper so it will not hold strong in court if things go wrong and I am sure you as an investor wont have much time to contest it.

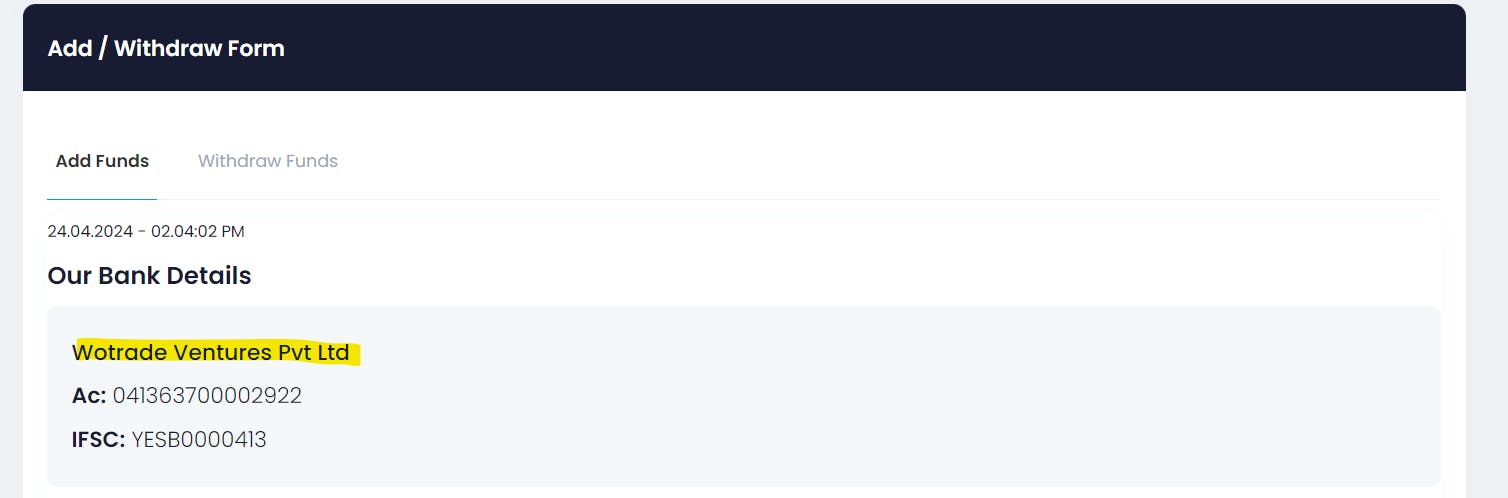

#5 No Escrow Account Details

When I try to add money into their wallet, the money is instructed to be added to the Private Limited account which is with YES Bank. The investor does not have a designated escrow account where his money can stay safe under their name. If you have money in this wallet and the company goes bankrupt, your money will be gone too, you have no right to claim. This is similar to what we highlighted in our first red flag article on Falcon Invoice Discounting. You can read that article here.

This is also high risk as you don't know how your money is being utilized once it reaches the bank accounts of the company.

Conclusion

These are all the red flags we could identify at this stage, I cannot be sure on how legit the overall business is, but given the above red flags, I would think 100 times before putting my money on this platform even if they offer me 50% IRR returns.

Returns are worthless if you end up losing 100% of your initial principal. Again, this article is for information purposes only and you are the best person to make a decision whether you would like to invest in this platform or not. ALT Investor has no formal recommendation on this.

Lastly, many thanks to all our community members who helped us corroborate various red flag and provided us with necessary deal documents wherever possible.

If you would like to join our Whatsapp Community, please apply via this link.

If you would like to get notified of deals in Alternative Investments directly from platform owners, please join this Whatsapp Channel where your details stay anonymous.

Please note that this is an opinion blog and not official research advice. I am not a registered RIA in India, and none of these views reflect those of my current employer. This blog aims to promote informed decision-making and does not discourage you from investing in any deals.

We plan to come up with more blogs discussing different types of instruments available in the world of startup investing, write on due diligence for some platforms, and also existing and upcoming alt investment deals in the Indian market. If you want to stay updated on the latest blogs, please subscribe to our newsletter so you get notified automatically.